Student Loans in the UK: Everything You Need to Know

Introduction

Higher education in the United Kingdom has become increasingly expensive over the past decade. Tuition fees alone for undergraduate degrees can reach up to £9,250 per year at public universities, and when combined with living expenses, course materials, and other costs, many students struggle to afford their studies. Student Loans in the UK As a result, student loans have become a critical financial tool for enabling access to higher education. Best Home Insurance Providers in the UK

Student loans in the UK are designed to help students cover the costs of tuition and living expenses while studying, offering flexible repayment options that adjust according to income. However, understanding how these loans work, their repayment structures, and long-term implications is crucial to making informed financial decisions. Poor planning or misunderstandings about interest rates can lead to unnecessary debt burdens post-graduation.

In this guide, we will break down everything you need to know about student loans in the UK—from application processes to repayment strategies. Whether you are a prospective undergraduate, a postgraduate, or an international student, this comprehensive article will provide actionable insights to help you navigate student financing responsibly. Low Interest Personal Loans Canada

What are Student Loans in the UK?

Student loans in the UK are financial products designed to assist students in paying for higher education costs. There are primarily two types: government-backed loans and private loans.

-

Government Student Loans: Offered through Student Finance England, Student Finance Wales, Student Finance Northern Ireland, and Student Awards Agency for Scotland (SAAS), these loans typically cover tuition fees and, in some cases, living costs. They are generally more favorable than private loans, with income-contingent repayment plans and lower interest rates. Small Business Loans in USA

-

Private Student Loans: These are offered by banks and private lenders. They often have stricter eligibility requirements and higher interest rates but can supplement government loans if additional funding is needed.

Student loans in the UK are repayable only once the student’s income exceeds a certain threshold. This means that repayment is based on your ability to pay, reducing the financial pressure during early career stages.

How to Apply for a Student Loan in the UK

Applying for a student loan is a straightforward process, but it requires careful attention to deadlines and documentation.

Step-by-Step Guide:

-

Determine Eligibility: Check residency requirements, age limits, and whether you are applying as an undergraduate, postgraduate, or part-time student. International students may have different criteria.

-

Choose Loan Type: Decide whether you need tuition fee loans, maintenance loans, or a combination of both. Personal Loans for Bad Credit in Canada

-

Gather Required Documents: Typically, you’ll need:

-

Passport or National ID

-

Proof of residency

-

University acceptance letter

-

Bank account details

-

Income information for dependent assessment

-

-

Submit Application: Apply online via the respective Student Finance body for your region.

-

Receive Loan Offer: Review terms, including interest rates and repayment schedule.

-

Confirm Acceptance: Accept the loan and ensure your university receives confirmation.

Types of Student Loans Available

Understanding the different types of student loans helps in planning your finances effectively.

-

Tuition Fee Loans: Cover the cost of tuition, paid directly to your university. Personal Loans in the UK

-

Maintenance Loans: Help cover living costs, such as accommodation, food, and transport.

-

Postgraduate Loans: Available for master’s and doctoral degrees. Usually smaller than undergraduate loans but similarly structured.

-

Private Loans: Supplementary loans for students needing additional funds beyond government loans.

Top UK Lenders Offering Student Loans

While government loans are most common, some private institutions offer competitive student loans:

-

HSBC UK: Offers fixed-rate loans for tuition fees. Best Homeowners Insurance Providers 2025

-

NatWest: Provides postgraduate loans with flexible repayment options.

-

Barclays: Offers student loans and financial planning advice.

-

Government Student Finance: Accessible through regional bodies; most favorable terms.

Repayment Options and Plans

Repayment for UK student loans depends on your income after graduation. For instance:

-

Plan 1: For students in England before September 2012, repayment starts at £22,015/year.

-

Plan 2: For students after September 2012, repayment threshold is £27,295/year.

-

Postgraduate Loans: Typically start repayment at £21,000/year. Best Personal Finance Software for Families

Income-based repayment ensures that graduates only pay a percentage of their income above the threshold, reducing financial stress.

Interest Rates on UK Student Loans

Interest rates vary by loan type and income. Generally:

-

Undergraduate Loans: Interest is RPI (Retail Price Index) + up to 3%, depending on income.

-

Postgraduate Loans: Fixed interest rate around 6–7% for new loans.

Interest accrues from the time the loan is disbursed but only affects repayment after the income threshold is reached.

Benefits of Taking a Student Loan

-

Access to Education: Allows students to pursue degrees they might not afford otherwise.

-

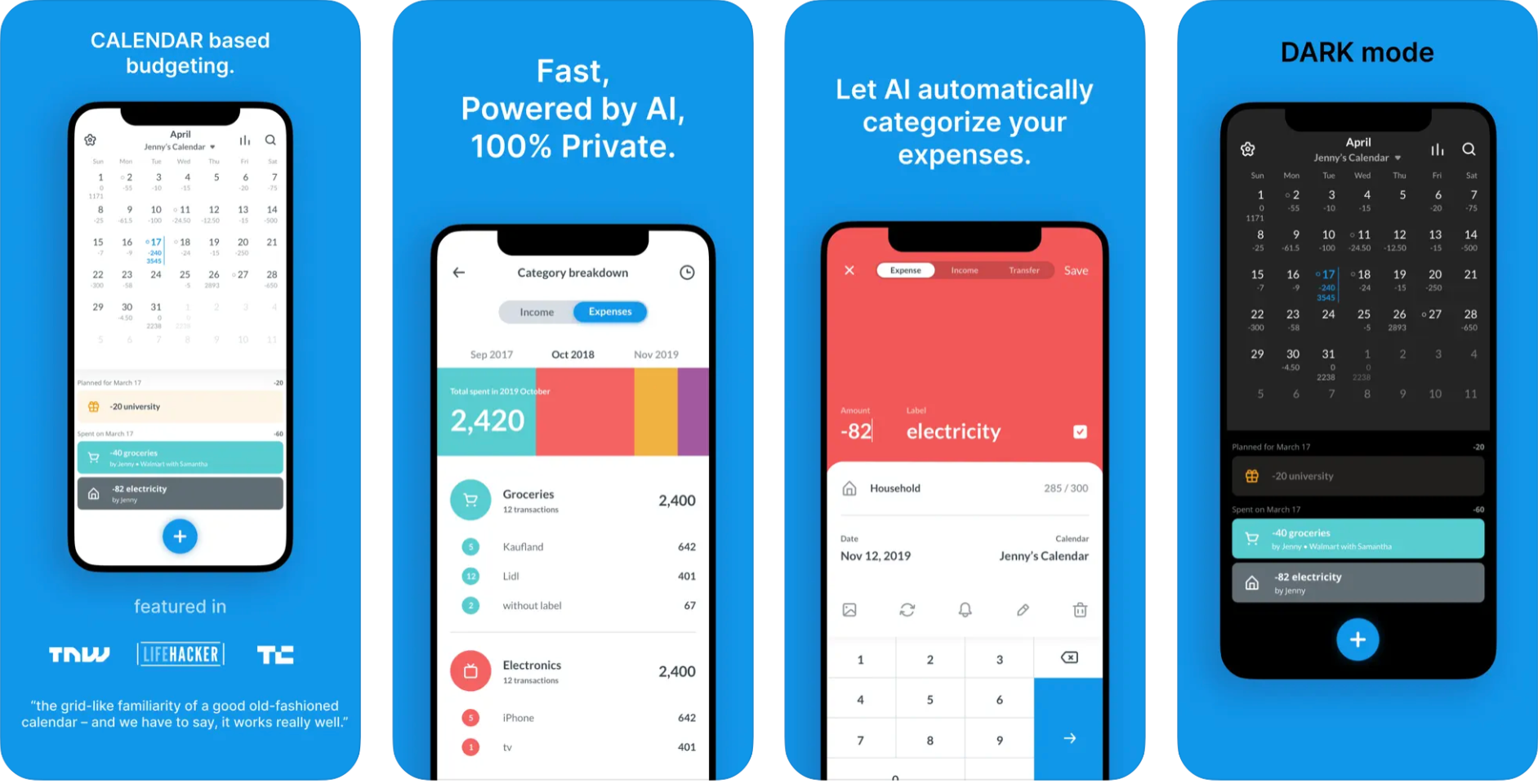

Flexible Repayment: Income-based repayment ensures affordability. YNAB vs Mint vs EveryDollar

-

Financial Planning: Builds credit history when managed responsibly.

Challenges of Student Loans

-

Debt Accumulation: Large loans can take decades to repay.

-

Interest Compounding: High interest rates can increase total repayment. Private Health Insurance Comparison

-

Delayed Financial Freedom: Loan obligations can affect long-term financial decisions.

Impact of Student Loans on Future Earnings

| Loan Type | Average Debt (£) | Typical Starting Salary (£) | Estimated Monthly Repayment (£) |

|---|---|---|---|

| Undergraduate Loan | 40,000 | 28,000 | 150 |

| Postgraduate Loan | 10,000 | 30,000 | 75 |

| Combined Loans | 50,000 | 28,000 | 200 |

Tips for Managing Student Loan Debt

-

Budgeting: Track income and expenses to avoid unnecessary debt.

-

Overpayment: Pay extra when possible to reduce interest. Best Stock Trading Platforms

-

Refinancing: Explore options if private loans are involved.

-

Government Support: Check eligibility for grants or bursaries.

Common Myths About Student Loans

-

“You must start repaying immediately” – False; repayment depends on income. Best Budgeting Apps

-

“Student loans ruin your credit” – False; responsible repayment can improve credit history.

-

“International students cannot access loans” – False; some regional programs allow partial funding.

Student Loan FAQs

Q: Do I have to repay if I don’t graduate?

A: Yes, repayment is based on funds received, not graduation status. Cheapest Car Insurance Companies

Q: Can I pause repayment?

A: Yes, under certain conditions like low income or illness.

Q: Are loans interest-free while studying?

A: Interest accrues, but repayment doesn’t start until you earn above the threshold.

Conclusion

Student loans in the UK provide critical support for higher education, enabling students to focus on learning without immediate financial strain. Cheap Health Insurance Quotes Online Understanding loan types, repayment plans, and strategies for debt management is essential to maximize benefits and minimize challenges. By planning wisely, students can access education, manage repayments efficiently, and maintain financial health post-graduation.