Student Finance for International Students in the UK

Introduction

Studying in the UK is a dream for thousands of international students every year. With world-renowned universities, diverse academic programs, and a vibrant cultural experience, the UK remains a top destination for higher education. However, the rising cost of tuition and living expenses can make studying abroad financially challenging. Student Finance for International Students in the UK International students often face higher fees than domestic students, and the lack of access to local student funding makes financial planning essential.

Affordability is a key concern. Tuition fees in the UK vary depending on the course and university, ranging from £10,000 to over £38,000 per year for undergraduate and postgraduate programs. Accommodation, transport, food, and daily living costs add thousands more annually. Without careful planning and access to student finance, these costs can quickly become overwhelming.

Student finance for international students encompasses a variety of funding options including scholarships, grants, private loans, and budgeting strategies. Understanding these options can make the difference between a manageable study experience and accumulating unmanageable debt. This guide provides a comprehensive overview of how international students can finance their education in the UK, plan their budgets, and maximize funding opportunities.

What is Student Finance?

Student finance refers to the various forms of financial support available to help students cover the cost of their studies. For international students, this typically includes:

-

Tuition Fee Loans: Borrowed funds to pay university tuition.

-

Living Cost Loans: Funds to help cover accommodation, food, and daily expenses.

-

Grants and Scholarships: Non-repayable funds awarded based on merit, need, or specific criteria.

-

Bursaries: Smaller, need-based awards offered by universities or external organizations.

Unlike domestic students, international students often have limited access to government-funded loans. Therefore, private loans, scholarships, and family support play a significant role in financing education abroad. Understanding each option is critical for making informed financial decisions.

Eligibility for Student Finance for International Students

Eligibility criteria vary depending on the type of funding:

-

Visa Status: Most loans or funding programs require the student to hold a valid student visa.

-

Residency Requirements: Some scholarships may be limited to students from certain countries or regions.

-

Academic Requirements: High academic performance or enrollment in specific courses may be necessary.

-

Age and Course Level: Some loans are restricted to undergraduate or postgraduate students, and age limits may apply.

Careful research is essential to ensure that international students meet all eligibility requirements before applying for finance.

Types of Student Loans Available

International students can access several types of loans to fund their education:

-

Private Bank Loans: Many UK and international banks offer education loans to cover tuition and living costs. Interest rates and repayment terms vary, so comparison is essential.

-

International Student Loans: Some lenders specialize in funding international students without requiring a UK co-signer.

-

Government-Linked Loans: Certain bilateral agreements between the UK and other countries allow eligible students to access low-interest loans.

-

University Loans: Some UK universities provide institutional loans or deferred payment plans for tuition.

Understanding the benefits and obligations of each loan type helps students choose the most cost-effective and feasible solution.

How Much Financial Support Can You Get?

The amount of funding available depends on the program, lender, and eligibility. Typical ranges include:

-

Tuition Fee Loans: £5,000–£38,000 per year depending on course and university.

-

Living Cost Loans: £6,000–£12,000 per year for accommodation, food, and daily expenses.

-

Scholarships and Grants: Varies widely; some cover full tuition and living costs, others partial amounts.

Students must calculate their total cost of living, including rent, transportation, food, and health insurance, to determine how much additional funding they require.

Repayment Options and Interest Rates

Repayment terms differ depending on the type of loan:

-

Government or Institutional Loans: Typically repayable after graduation once income exceeds a threshold. Interest rates may be fixed or income-based.

-

Private Loans: Fixed repayment schedules, often requiring monthly installments regardless of income. Interest rates may be higher for international students.

-

Grace Periods: Some loans offer a deferment period while the student completes studies.

Understanding repayment obligations is essential to avoid long-term financial stress. Planning early and budgeting for repayment is recommended.

Scholarships and Bursaries for International Students

Scholarships are a crucial resource for reducing the financial burden:

-

University-Specific Scholarships: Offered by individual universities; may cover tuition, living costs, or both.

-

Government Scholarships: Programs like the Chevening Scholarship, Commonwealth Scholarships, or GREAT Scholarships provide full or partial funding.

-

Private and External Scholarships: Offered by foundations, companies, or NGOs; often merit-based.

-

Bursaries: Smaller, targeted awards to support students in financial need.

Students are encouraged to research and apply to multiple scholarships to maximize funding opportunities.

Budgeting Tips for International Students

Effective budgeting is key to making student finance work:

-

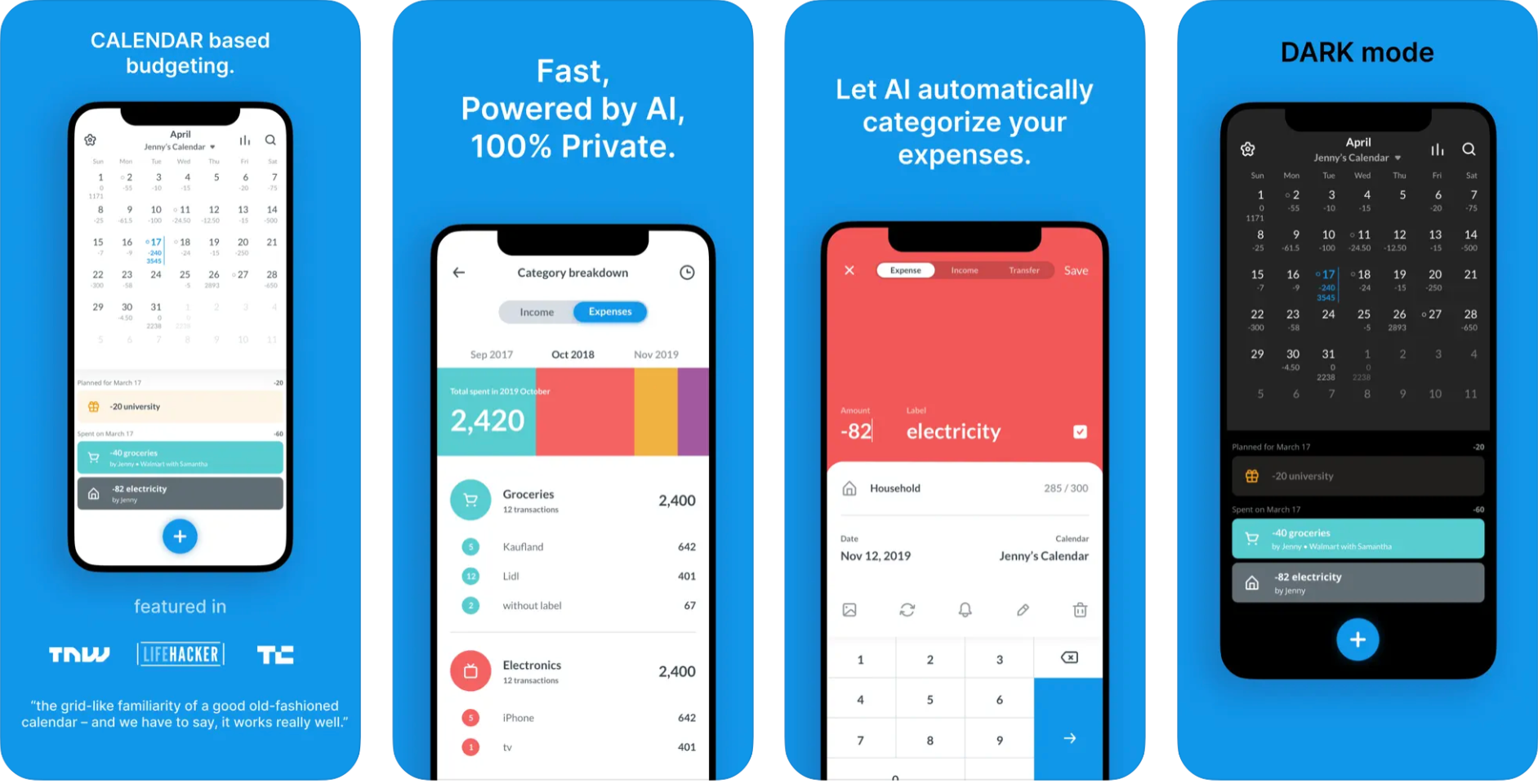

Track Expenses: Use apps or spreadsheets to record daily spending.

-

Affordable Accommodation: Consider university halls, shared housing, or homestays.

-

Transport Savings: Use public transport, student passes, or cycling to reduce costs.

-

Food and Essentials: Cook at home, shop at discount stores, and use student discounts.

-

Leisure and Entertainment: Limit discretionary spending; seek free or low-cost cultural events.

Budgeting ensures students stretch their financial support across the academic year without unnecessary debt.

Bank Accounts and Financial Services for Students

Opening a UK bank account is critical for managing finances:

-

Student Bank Accounts: Often come with overdraft facilities and fee-free transactions.

-

Mobile Banking Apps: Useful for budgeting, monitoring transactions, and transferring funds internationally.

-

Online Payment Platforms: Facilitate tuition payments and living expenses management.

Choosing the right banking solution simplifies access to funds and helps avoid additional fees.

Insurance Considerations for International Students

While student finance primarily addresses tuition and living costs, insurance remains important:

-

Health Insurance: International students must comply with the UK’s NHS surcharge for visa applications.

-

Travel Insurance: Protects against medical emergencies, lost luggage, and unexpected travel interruptions.

-

Contents Insurance: Covers personal belongings in university accommodation.

Insurance costs should be included in the overall student budget to prevent unexpected expenses.

How to Apply for Student Finance for International Students in the UK

-

Research Funding Options: Identify loans, scholarships, and bursaries that match eligibility.

-

Prepare Documents: Passport, visa, admission letters, proof of finances, and academic transcripts.

-

Submit Applications: Apply for loans or scholarships through official portals.

-

Await Approval: Check for confirmation and any additional requirements.

-

Access Funds: Set up bank accounts to receive tuition and living cost support.

Websites and Tools to Find Student Finance Options

-

Gov.uk Student Finance Portal – Official government loan and grant information

-

Scholarship Search Platforms: ScholarshipPortal, Chevening, British Council

-

University Financial Aid Offices – Guidance for institutional funding

-

Budgeting Apps: Mint, Yolt, or Monzo for managing daily expenses

These tools help students find reliable and up-to-date financial support options.

FAQs About Student Finance for International Students

Q1: Can international students get UK government loans?

A: Typically no, but some bilateral agreements or local government schemes may exist.

Q2: What scholarships are available for non-EU students?

A: Chevening, Commonwealth, GREAT Scholarships, and university-specific awards.

Q3: How long does it take to receive loan funds?

A: Usually after approval and setting up a UK bank account, funds may be released at term start.

Q4: Can student loans cover living expenses?

A: Yes, many loans include separate living cost allowances.

Conclusion on Student Finance for International Students in the UK

International students can successfully fund their studies in the UK with careful planning. By exploring loans, scholarships, bursaries, and financial services, students can cover tuition and living costs without excessive debt. Combining budgeting strategies with research into financial support ensures a sustainable and rewarding academic experience abroad.