Best Home Insurance Providers in the UK

Introduction

Owning a home in the UK is a significant investment, and protecting it from unexpected events is more crucial than ever. Best Home Insurance Providers in the UK With rising property values and the cost of living continuing to escalate, homeowners face an increasing risk of financial strain if their homes or possessions are damaged. Whether it’s a burst pipe, a storm, or an accidental fire, the costs of repair and replacement can quickly become overwhelming. Home insurance acts as a safety net, ensuring that both your property and your peace of mind are safeguarded. Low Interest Personal Loans Canada

Affordability is a major consideration for many UK homeowners. While comprehensive coverage is essential, the rising cost of premiums often forces families to search for policies that provide adequate protection without breaking the bank. Balancing cost with coverage requires a careful comparison of providers, understanding what is included in each policy, and being aware of potential exclusions.

This guide explores the best home insurance providers in the UK, detailing the types of coverage available, typical costs, the benefits and challenges of various policies, and practical steps for securing the most suitable insurance. By the end of this article, you will have all the tools needed to choose the best provider for your needs and budget. Small Business Loans in USA

What Are the Top Home Insurance Companies in the UK?

Top home insurance companies in the UK are recognized not only for competitive premiums but also for reliability, excellent customer service, and fast claims handling. Choosing a reputable insurer provides peace of mind, ensuring that in times of emergency, financial support and guidance are readily available. Personal Loans for Bad Credit in Canada

Financial stability is a key factor. Leading insurers have the resources to cover large claims without delay. Legal protection is another important aspect, as many policies include coverage for liability issues such as accidental injury to a visitor on your property.

Some of the most respected providers in the UK include Aviva, Direct Line, Churchill, Admiral, and AXA. These companies have consistently demonstrated strong claims handling, flexible coverage options, and customer-focused services, making them top choices for homeowners seeking reliable protection.

How Does Home Insurance Work in the UK?

Home insurance policies in the UK are designed to cover your property and belongings against unexpected events. Typically, there are two main types of coverage: buildings insurance and contents insurance. Buildings insurance protects the physical structure of your home, including walls, roof, floors, and permanent fixtures. Contents insurance covers your personal belongings, such as furniture, electronics, and clothing, from theft, fire, or damage. Personal Loans in the UK

New homeowners or students renting property may benefit from tailored policies. For instance, student accommodation policies often cover rented items without requiring the student to insure the entire building. Landlords, on the other hand, need specific landlord insurance that covers both the property structure and potential liability issues with tenants.

Many insurers also offer optional add-ons such as accidental damage cover, home emergency assistance, or legal protection. These extras enhance the policy’s scope but may increase the premium. Understanding your needs and choosing the right combination of coverage ensures optimal protection without unnecessary cost. Best Homeowners Insurance Providers

Policies operate on a renewal basis, usually annually. Premiums are calculated based on factors such as property location, rebuild cost, security features, and claims history. In the event of a claim, the insurer assesses the damage and provides compensation based on the terms of the policy.

How Much Does Home Insurance Cost in the UK?

The cost of home insurance in the UK varies significantly depending on location, property type, and the coverage level selected. On average, homeowners can expect to pay between £250 and £500 annually for a standard combined buildings and contents policy. However, premiums in London and the South East tend to be higher due to increased property values and higher risk factors. Best Personal Finance Software for Families

Factors affecting premiums include: ‘Best Home Insurance Providers in the UK’

-

Property location: Areas prone to flooding or high crime may attract higher premiums.

-

Rebuild value: The cost to rebuild your property from scratch influences buildings insurance pricing.

-

Security measures: Homes with alarms, CCTV, or secure locks often receive discounts.

-

Claims history: Previous claims can increase premiums.

By comparing providers and considering regional differences, homeowners can find affordable coverage that still meets their protection needs.

Types of Home Insurance Policies in the UK

- Buildings Insurance: Covers the structure of your home, including walls, roof, floors, and permanent fixtures.

- Contents Insurance: Protects personal belongings inside the home, from electronics to clothing.

- Combined Buildings & Contents Insurance: Offers the convenience of covering both the property structure and contents in a single policy.

Specialist Policies

-

Landlord insurance – tailored for rented properties, covering both structure and tenant-related liabilities. YNAB vs Mint vs EveryDollar

-

Student housing cover – often focuses on contents rather than the building.

-

Listed building insurance – covers older or historic properties with unique rebuild requirements.

-

Holiday homes – protects second homes or vacation properties, often with seasonal coverage.

Top Home Insurance Providers in the UK (2025 Edition)

- Aviva: A comprehensive insurer with multiple coverage options, competitive pricing, and strong claims support.

- Direct Line: Offers flexible add-ons, excellent customer service, and specialized policies for different homeowner needs.

- Churchill: Known for affordability and discounts when combining multiple policies.

- Admiral: Provides multi-policy discounts and competitive pricing, ideal for families. Private Health Insurance Comparison

- AXA: Focuses on high-value contents coverage and comprehensive protection plans.

- LV= (Liverpool Victoria): Highly rated for claims handling and customer support, with a variety of policy options.

- Saga: Specializes in policies for homeowners over 50, offering tailored coverage and benefits.

- Nationwide: Offers perks for members and competitive rates for standard coverage.

- More Than: Well-regarded for comprehensive contents insurance and flexible add-ons.

- Tesco Bank: Provides rewards for Clubcard members and competitive premiums for combined policies.

What’s Typically Covered by Home Insurance?

-

Fire, storm, flood, and theft damage.

-

Accidental damage to fixtures and fittings.

-

Liability cover for injuries on your property.

-

Temporary accommodation if your home becomes uninhabitable due to insured events.

What’s Not Covered by Standard Home Insurance?

-

General wear and tear or poor maintenance. Best Stock Trading Platforms 2025

-

Damage caused by pests or vermin.

-

High-value items unless explicitly declared.

-

Deliberate damage or criminal activity by the policyholder.

Benefits of Choosing the Right Home Insurance

-

Protection from unexpected expenses.

-

Peace of mind for homeowners and families.

-

Additional coverage options such as legal assistance and home emergency services.

-

Potential cost savings through multi-policy or loyalty discounts.

Challenges of Finding Affordable Home Insurance

-

Higher excess or limited coverage may be required for cheaper premiums. Cheapest Car Insurance Companies 2025

-

Regional variations can make some areas more expensive.

-

Risk of underinsurance if homeowners prioritize cost over coverage.

Is Home Insurance Worth It in the UK?

Home insurance is essential both legally and financially. Most mortgage lenders require buildings insurance as part of the loan agreement. Without insurance, homeowners risk paying out-of-pocket for repairs or replacements, which can be prohibitively expensive. Cheap Health Insurance Quotes Online

Case studies have shown that an annual premium of £300–£400 can prevent losses exceeding tens of thousands of pounds in case of fire or flood. For landlords and families, the cost of protection is far outweighed by the potential financial impact of uninsured damage.

Application Requirements and Documents Needed

-

Proof of address.

-

Property details (age, construction, size).

-

Security features (alarms, locks, CCTV).

-

Previous claims history and insurance documents if switching providers.

Top 5 Cheapest Regions in the UK for Home Insurance

-

North East England – Lower property values and reduced crime rates.

-

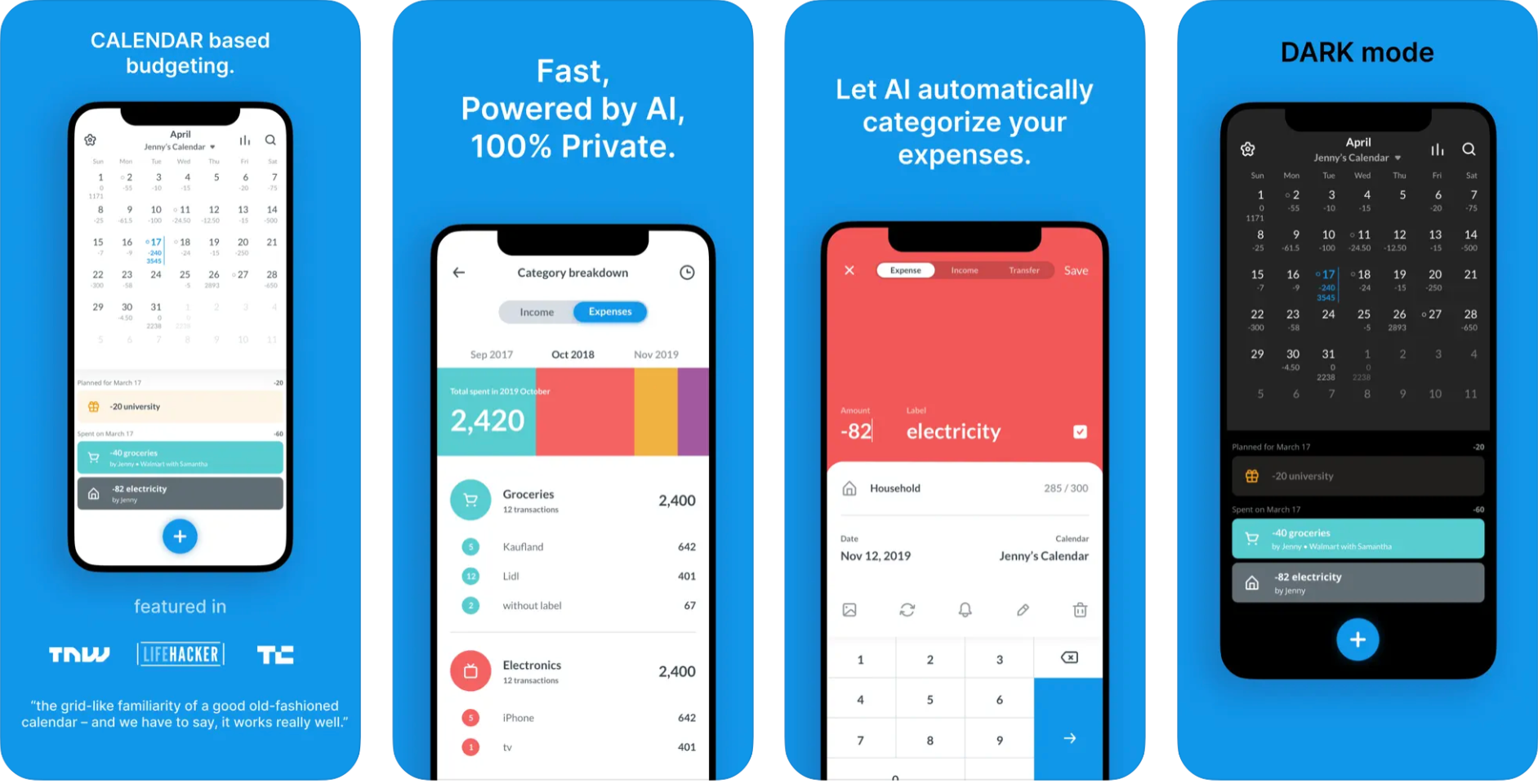

Scotland (rural areas) – Fewer claims, low population density. Best Budgeting Apps 2025

-

Wales (rural regions) – Lower rebuild costs and reduced risk of flooding in some areas.

-

Northern Ireland – Affordable premiums for average property types.

-

Yorkshire & the Humber – Competitive market and moderate property values.

Salary vs. Premium Comparison: UK Household Budgets

| Region | Average Annual Income | Average Home Insurance Premium | % of Income |

|---|---|---|---|

| London | £45,000 | £500 | 1.1% |

| South East England | £42,000 | £450 | 1.07% |

| North East England | £30,000 | £300 | 1% |

| Scotland (rural) | £32,000 | £280 | 0.88% |

| Wales (rural) | £29,000 | £270 | 0.93% |

Step-by-Step Guide: How to Apply for Home Insurance in the UK

-

Research providers – Identify top-rated insurers and compare policy offerings.

-

Compare quotes online – Use comparison websites to find competitive rates.

-

Assess coverage needs – Decide between building, contents, or combined insurance.

-

Customize policy – Add optional coverage like accidental damage or home emergency.

-

Submit documentation – Provide proof of address, property details, and security features.

-

Approval and activation – Once approved, your policy starts protecting your home immediately.

Websites and Tools to Compare Home Insurance in the UK

-

MoneySuperMarket – Easy comparison of premiums and coverage.

-

Compare the Market – Offers competitive quotes from major providers.

-

GoCompare – Includes user reviews and comprehensive policy details.

-

Confused.com – Simplifies price comparison with clear ratings.

-

Provider websites and mobile apps – Often have exclusive discounts and offers.

FAQs about Home Insurance in the UK

Is home insurance mandatory?

-

Buildings insurance is generally required if you have a mortgage. Contents insurance is optional but recommended.

Can I switch providers mid-policy?

-

Yes, but check for cancellation fees and pro-rata refunds.

What happens if I undervalue my contents?

-

Claims may be reduced proportionally, so it’s important to declare accurate values.

How can I lower my premium?

-

Improve security, increase excess, combine policies, or shop around for competitive quotes.

Conclusion: Choosing the Best Home Insurance Provider in the UK

Selecting the right home insurance provider involves balancing cost, coverage, and reliability. While affordability is important, homeowners must ensure that policies provide comprehensive protection for their property and belongings. By comparing providers, understanding policy inclusions and exclusions, and using comparison tools, you can secure coverage that offers peace of mind without overstretching your budget. Protecting your home is not just a financial decision—it’s an investment in security, safety, and long-term stability.