Best Budgeting Apps 2025: The Ultimate Guide to Managing Money in the Digital Age

Introduction

In today’s fast-paced digital world, managing money has become both easier and more challenging at the same time. With rising living costs, economic uncertainty, and the increasing importance of financial literacy, budgeting has moved from being a “good habit” to a necessary life skill in 2025. The good news? Technology has evolved to support this shift. The best budgeting apps in 2025 now offer more than just spreadsheets or expense tracking — they provide AI-powered insights, real-time syncing, and personalized financial strategies that help users achieve financial stability and long-term goals.

Best Personal Finance Software for Families in 2025

Budgeting apps have grown in popularity over the last decade, but their role in 2025 has become indispensable. According to recent statistics, over 65% of millennials and Gen Z rely on at least one personal finance app to track spending, save for big purchases, or manage debt. Whether you are a student, a working professional, or a small business owner, the need to control your cash flow has never been more pressing. Apps that once merely recorded expenses are now evolving into financial ecosystems — offering bill reminders, investment tracking, credit score monitoring, and even savings automation.

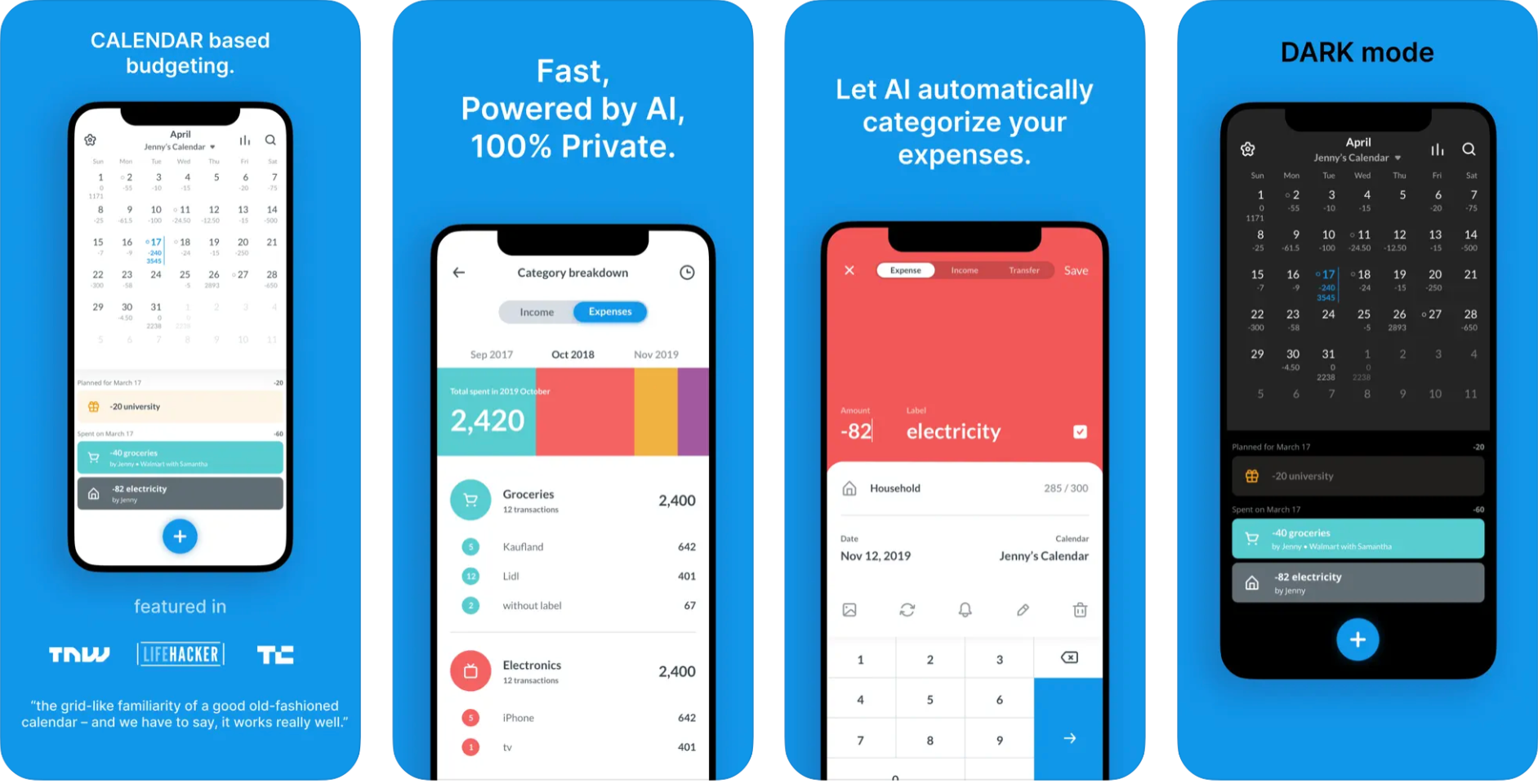

best budgeting app 2025

The importance of finding the right budgeting app goes beyond convenience. In 2025, where digital payments, subscription services, and inflation-driven expenses dominate, it’s easy to lose track of money without a smart system in place. Choosing the best budgeting app 2025 means selecting a tool that not only tracks your money but actively helps you grow it. With so many options available, consumers are asking: Which budgeting apps actually deliver results, and which are just hype?

This comprehensive guide explores everything you need to know about budgeting apps in 2025. From definitions and benefits to challenges, strategies, and the top-rated apps for personal finance, we will break down the features, pros and cons, and real-world examples that can help you make an informed decision. Whether you’re saving for retirement, paying off debt, or simply trying to live within your means, this article will serve as your roadmap to financial freedom in the digital age.

What Are Budgeting Apps?

Budgeting apps are digital tools designed to help individuals and families manage income, expenses, and savings in a structured way. Unlike traditional spreadsheets or manual note-taking, these apps automate much of the process, offering real-time updates and financial analysis. Most apps link directly to your bank accounts, credit cards, and digital wallets, ensuring accuracy and convenience.

In 2025, budgeting apps have become more intelligent and adaptive. Features now include:

-

AI-powered spending insights that predict your future expenses.

-

Subscription management tools to prevent hidden or forgotten charges.

-

Automated savings transfers to help build emergency funds.

-

Debt payoff calculators for managing student loans, mortgages, and credit cards.

-

Goal-setting dashboards for vacations, home purchases, or retirement.

These apps act as digital financial assistants, empowering users to take full control of their money.

Why Budgeting Apps Are Important in 2025

The financial landscape of 2025 is more complex than ever. Rising inflation, the gig economy, and the surge of digital transactions mean that traditional money management methods are no longer sufficient. Here’s why budgeting apps matter now more than ever:

-

Cost of Living Management: With global inflation averaging 6–8% in many countries, tracking and adjusting spending is essential.

-

Automation Saves Time: Apps reduce the burden of manual tracking, ensuring users don’t miss payments or overspend.

-

Debt Reduction: Credit card debt and student loans remain high, making debt management tools critical.

-

Financial Literacy: Apps provide educational resources and insights, helping users build smarter financial habits.

-

AI Customization: The best apps now tailor strategies to individual goals, unlike generic budgeting templates.

Simply put, budgeting apps in 2025 don’t just record numbers — they transform behavior and drive smarter financial decisions.

Challenges and Risks of Budgeting Apps

While budgeting apps are powerful, they also come with challenges and potential risks:

-

Data Privacy Concerns: With apps accessing sensitive financial information, security and encryption are crucial.

-

Subscription Costs: Some premium budgeting apps charge high monthly fees, which may deter budget-conscious users.

-

Over-Reliance: Users may depend too heavily on apps and neglect to build personal financial discipline.

-

Learning Curve: Some apps are feature-heavy, making them overwhelming for beginners.

-

Compatibility Issues: Not all apps integrate smoothly with every bank or payment platform.

Understanding these challenges helps users choose apps that balance features with security and affordability.

Best Budgeting Apps 2025

Here are the top-rated budgeting apps in 2025 based on usability, features, and customer reviews:

1. YNAB (You Need A Budget)

-

Focus: Goal-based budgeting.

-

Features: Zero-based budgeting, debt payoff tools, progress tracking.

-

Pros: Highly educational, great for debt management.

-

Cons: Subscription cost ($14.99/month).

2. Mint by Intuit

-

Focus: All-in-one money management.

-

Features: Expense tracking, credit monitoring, bill reminders.

-

Pros: Free version available, user-friendly interface.

-

Cons: Limited advanced features compared to competitors.

3. PocketGuard

-

Focus: Simplicity and automation.

-

Features: “In My Pocket” tool for daily spending limits.

-

Pros: Ideal for beginners.

-

Cons: Fewer advanced tools for power users.

4. Monarch Money

-

Focus: Long-term financial planning.

-

Features: Investment tracking, joint accounts, collaboration tools.

-

Pros: Great for families and couples.

-

Cons: Premium pricing.

5. Goodbudget

-

Focus: Envelope-style budgeting.

-

Features: Digital envelope system, cash-flow management.

-

Pros: Great for manual planners.

-

Cons: Not as automated as other apps.

Step-by-Step Guide: How to Choose the Best Budgeting App

-

Identify Your Goals (debt reduction, saving, investing).

-

Compare Features (automation, syncing, goal-setting).

-

Check Compatibility with your bank and payment systems.

-

Evaluate Pricing (free vs. subscription).

-

Test User Experience through free trials or demo versions.

-

Prioritize Security (look for encryption and two-factor authentication).

Pros & Cons of Budgeting Apps in 2025

Pros:

-

Saves time and effort.

-

Provides real-time insights.

-

Encourages financial discipline.

-

Integrates multiple accounts.

-

Supports long-term financial planning.

Cons:

-

Can be costly (premium apps).

-

Risk of data breaches.

-

Requires consistent usage.

-

Overwhelming features for beginners.

Real-World Examples and Statistics

-

Statista 2025 reports that over 78% of Americans use at least one financial management app.

-

Users who adopt budgeting apps save an average of $300–$600 per month by cutting unnecessary expenses.

-

A case study by YNAB showed that the average user saves $6,000 in the first year.

-

Families using collaborative apps like Monarch Money report improved financial communication and reduced household conflicts.

FAQs

1. What is the best budgeting app in 2025?

YNAB and Mint remain the most popular choices, but the best app depends on individual needs.

2. Are budgeting apps worth the subscription cost?

Yes, especially if the app helps you save more than the subscription fee.

3. How do budgeting apps keep my data safe?

Most apps use bank-level encryption and two-factor authentication to protect your financial information.

4. Can budgeting apps help reduce debt?

Yes. Many apps provide debt payoff calculators and personalized repayment plans.

5. Do free budgeting apps work as well as paid ones?

Free apps are great for beginners, but paid apps usually offer advanced features like investment tracking.

6. Which budgeting app is best for families?

Monarch Money is highly recommended for couples and families due to its collaborative tools.

7. What is the average cost of budgeting apps in 2025?

Most premium apps cost between $5–$15 per month.

8. Can I use multiple budgeting apps at the same time?

Yes, but it may cause duplicate tracking. It’s best to stick with one reliable app.

9. Do budgeting apps work offline?

Some apps like Goodbudget offer limited offline functionality, but most require internet access.

10. How accurate are budgeting apps?

Accuracy depends on syncing with financial institutions, but most apps are highly reliable.

Conclusion

Budgeting in 2025 is no longer optional — it’s essential. With inflation, digital payments, and lifestyle changes reshaping how we spend and save, the right budgeting app can be the difference between financial stress and financial success. The best budgeting apps of 2025 combine automation, AI insights, and personalized planning to make managing money simpler, smarter, and more effective.

If you’re serious about improving your financial health, start by testing a few of the apps discussed in this guide. Identify your goals, compare features, and choose the one that aligns best with your lifestyle. Remember: a budgeting app is not just a tool — it’s a partner in your journey toward financial freedom.

👉 Ready to take control of your finances? Compare budgeting apps today and start building a brighter financial future.