Best Personal Finance Apps USA: Optimize Your Money in 2025

Introduction

Managing personal finances in the United States has never been more critical. With rising living costs, student loans, mortgage payments, and everyday expenses climbing steadily, individuals and families need practical tools to maintain control over their financial health. Personal finance apps have emerged as essential instruments, allowing users to track spending, save efficiently, and plan for future financial goals. Best Personal Finance Apps USA These apps not only streamline budgeting but also offer valuable insights into spending habits, helping users make informed decisions. Student Loans in the UK

The digital age has transformed the way Americans manage money. Gone are the days of pen-and-paper ledgers or relying solely on financial advisors. Today, users can access robust financial tools directly from their smartphones, enabling them to monitor accounts, set savings targets, and even invest with minimal effort. This level of convenience is especially crucial for busy professionals and students who need real-time information to make quick financial decisions.

Moreover, personal finance apps are becoming increasingly accessible. Many offer free versions with essential features, while premium options provide advanced analytics, personalized insights, and automated alerts. Whether you’re a young professional just starting your financial journey or a seasoned individual looking to optimize investments, choosing the right finance app can drastically improve financial stability, reduce stress, and promote long-term wealth building. Low Interest Personal Loans Canada

What Are the Top Personal Finance Apps?

Top personal finance apps combine financial management, legal compliance, and peace-of-mind features to ensure users can safely manage their money. These apps typically allow users to: Small Business Loans in USA

-

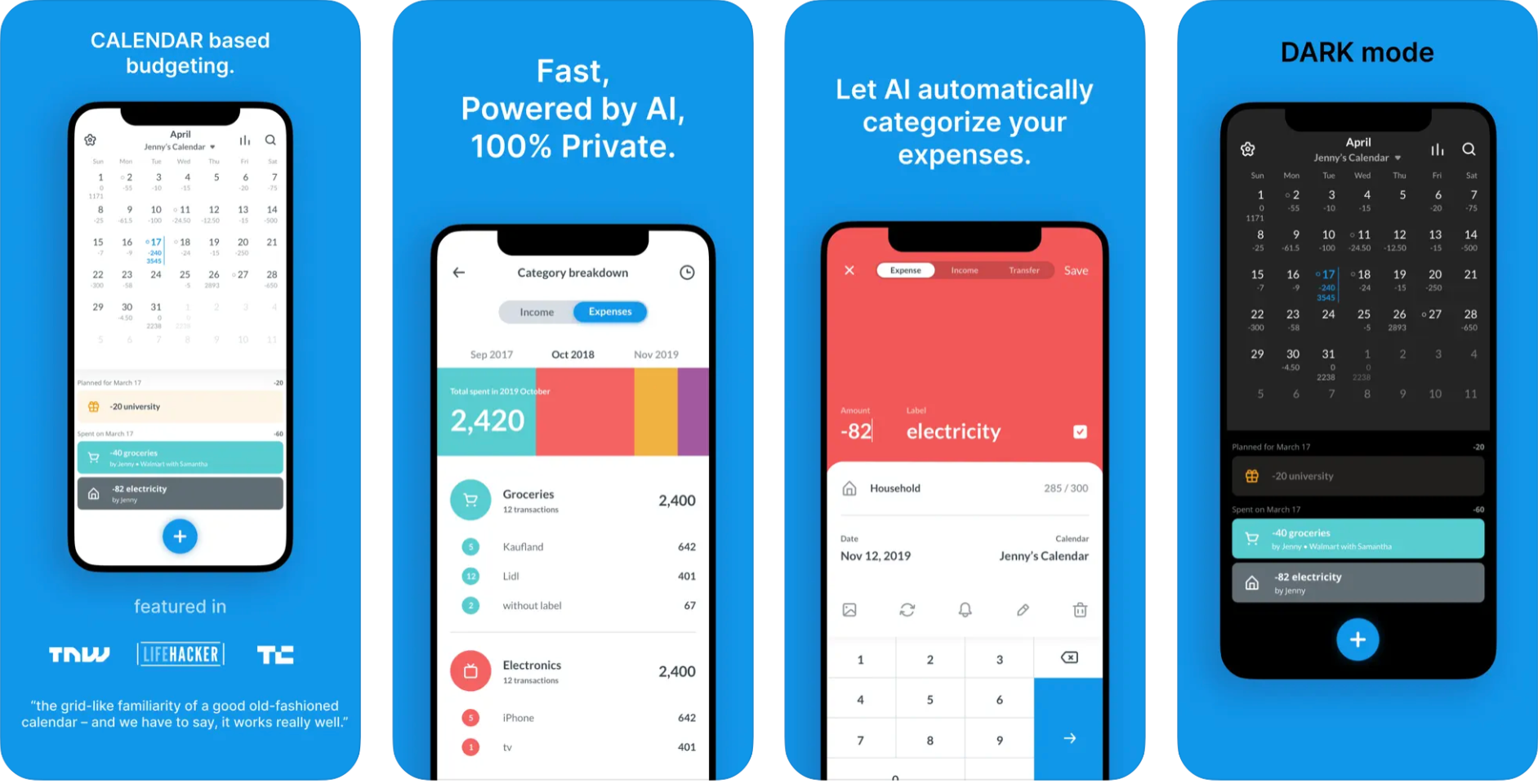

Track daily spending and categorize expenses automatically.

-

Set budgets and receive alerts when approaching limits.

-

Monitor credit scores and provide tips to improve credit health.

-

Offer secure integration with multiple bank accounts and credit cards.

Leading apps in the USA include Mint, YNAB (You Need a Budget), Personal Capital, PocketGuard, and Simplifi by Quicken. Each of these apps provides unique features tailored to different financial goals. For example, Mint excels in budgeting and expense tracking, while Personal Capital focuses on investment monitoring and wealth management. Best Home Insurance Providers in the UK

Other emerging apps, often regional or niche, offer innovative tools such as AI-based expense predictions, automatic savings, and bill negotiation services. By using these apps, Americans can not only manage their daily finances more effectively but also plan for long-term financial security, providing peace of mind in uncertain economic times.

How Do Budgeting and Finance Apps Work?

Budgeting and finance apps simplify money management by automating tasks that traditionally required manual effort. These tools link directly to bank accounts, credit cards, loans, and investment accounts to provide a unified view of your finances. Personal Loans for Bad Credit in Canada

For students and first-time earners, apps like YNAB offer step-by-step guidance on creating budgets, categorizing expenses, and prioritizing savings. Young professionals can leverage apps like PocketGuard to see exactly how much money is safe to spend after accounting for bills and savings goals.

Some apps also include AI-driven recommendations, which analyze spending patterns and suggest ways to cut costs. For example, if a user frequently overspends on dining, the app may suggest meal planning or cheaper alternatives. This kind of personalized advice helps users make better financial decisions without requiring deep financial knowledge. Personal Loans in the UK

Additionally, finance apps often provide visual analytics, such as charts, graphs, and weekly summaries, to help users understand their spending habits. Notifications and reminders ensure bills are paid on time, avoiding late fees and potential credit score damage. Best Personal Finance Apps USA! By consolidating multiple financial tasks into one platform, these apps make money management accessible, efficient, and even engaging for all age groups.

How Much Does It Cost to Use Personal Finance Apps?

The cost of using personal finance apps in the USA varies depending on the level of functionality. Most apps offer a free version that covers basic budgeting, expense tracking, and account linking. Premium subscriptions typically range from $5 to $15 per month, offering advanced features such as investment tracking, financial reports, and AI-driven insights. Best Homeowners Insurance Providers

Some apps also charge a one-time setup fee for lifetime access, especially for specialized tools like debt payoff trackers or retirement planning calculators. Users should carefully evaluate the features included in free versus premium plans to ensure they select the best value for their financial needs.

Types of Personal Finance Apps That Can Be Affordable

There are multiple types of finance apps, each catering to specific financial goals:

-

Budget Trackers – Help monitor income and expenses, set spending limits, and visualize cash flow.

-

Savings Apps – Automate savings by rounding up purchases or transferring a percentage of income into savings accounts. Best Personal Finance Software for Families

-

Investment Tools – Track stocks, ETFs, and retirement accounts, sometimes providing personalized investment advice.

-

Debt Management Apps – Focus on reducing credit card debt, student loans, and personal loans efficiently.

-

AI-Based Finance Apps – Provide predictive insights, bill reminders, and personalized recommendations.

Affordable apps often focus on one or two of these areas but remain effective in helping users improve financial health without high costs.

Top Companies Offering the Best Personal Finance Apps

Here’s a list of the most trusted apps available in the USA:

-

Mint – Free budgeting and expense tracking, credit score monitoring, bill reminders.

-

YNAB (You Need a Budget) – Paid app focusing on proactive budgeting and zero-based budgeting methodology. YNAB vs Mint vs EveryDollar

-

Personal Capital – Free for basic finance tracking; premium features for investment management.

-

PocketGuard – Free and subscription-based, emphasizes “safe-to-spend” budgeting.

-

Simplifi by Quicken – Affordable app for cash flow tracking, expense monitoring, and savings goals.

Best Personal Finance Apps USA. Emerging regional apps are also gaining traction, offering localized financial insights and support for niche user groups such as students or freelancers.

What’s Typically Covered by Premium Finance App Features?

Premium versions often include:

-

Automated categorization of transactions.

-

Advanced budgeting and forecasting. Private Health Insurance Comparison

-

Investment and retirement account tracking.

-

Credit score monitoring and alerts.

-

Bill payment reminders and subscription monitoring.

These features help users make informed financial decisions and save money in the long run.

What’s Typically Not Covered by Free Versions of Apps?

Free versions may lack:

-

Personalized financial advice.

-

Advanced reporting and visualizations.

-

Investment portfolio analysis.

-

Automated bill negotiation or expense optimization.

Users should weigh the cost of premium plans against potential financial gains from using advanced features.

Benefits of Choosing the Best Personal Finance Apps

Choosing the right finance app offers several advantages: Best Stock Trading Platforms 2025

-

Cost Savings – Identify and reduce unnecessary expenses.

-

Flexibility – Access financial data anytime via mobile or web.

-

Bundling Options – Some apps integrate banking, credit monitoring, and investing.

-

Financial Awareness – Visual reports help users understand spending patterns.

Challenges of Using Personal Finance Apps

Despite benefits, users may face challenges:

-

Data Privacy Concerns – Linking bank accounts raises security risks.

-

Subscription Fatigue – Multiple apps may lead to paying for overlapping features. Cheapest Car Insurance Companies

-

Learning Curve – Advanced features may require time to understand.

-

Limited Customization – Some apps may not accommodate unique financial situations.

Is a Personal Finance App Worth It?

For most users, a finance app is worth the investment. Free apps provide essential tools for budgeting and tracking, while premium apps offer advanced insights that can save money, improve credit scores, and promote long-term wealth. ROI is typically measured in money saved, debt reduced, and improved financial literacy.

Application Requirements and Documents Needed for App Setup

Most apps require:

-

Bank account credentials or login for account aggregation.

-

Personal identification for verification (SSN for credit-related features).

-

Email and phone number for notifications. Cheap Health Insurance Quotes Online

-

Optional: Financial statements for budgeting or investment tracking.

Security measures like two-factor authentication are standard to protect user data.

Top 10 States/Regions in the USA Using Finance Apps Most Efficiently

| Rank | State | Reason for Efficiency |

|---|---|---|

| 1 | California | High tech adoption, strong fintech culture |

| 2 | New York | Access to financial institutions, investment-focused users |

| 3 | Texas | Growing middle-class, emphasis on budgeting tools |

| 4 | Florida | Retirement planning apps popular among seniors |

| 5 | Washington | Early adoption of AI-driven financial tools |

These states have higher adoption rates due to financial literacy, tech accessibility, and urban demographics.

Salary vs. App Premiums Comparison

| State | Average Salary | Average Premium App Cost | % of Income |

|---|---|---|---|

| California | $75,000 | $120/year | 0.16% |

| New York | $70,000 | $150/year | 0.21% |

| Texas | $65,000 | $100/year | 0.15% |

| Florida | $60,000 | $110/year | 0.18% |

| Washington | $72,000 | $130/year | 0.18% |

Even premium app subscriptions represent a small fraction of income while offering significant value in financial management. Best Budgeting Apps

Step-by-Step Guide: How to Start Using the Best Personal Finance Apps

-

Research and shortlist apps based on your financial goals.

-

Download the app from a trusted source (App Store or Google Play).

-

Register with valid credentials and secure login.

-

Link bank accounts, credit cards, and loans securely.

-

Set budgeting, saving, and investment goals.

-

Customize notifications and alerts for spending and bills.

-

Review weekly and monthly reports to adjust financial behavior.

Websites and Tools to Find the Best Personal Finance Apps

-

NerdWallet – Expert reviews and comparisons.

-

Bankrate – Lists app features and ratings.

-

App Store / Google Play – User reviews and download counts.

-

FinExtra / Investopedia – Industry insights and app recommendations.

FAQs About Personal Finance Apps

Q1: Are finance apps safe to use?

Yes, most use bank-level encryption, but always enable 2FA.

Q2: Can I use multiple apps simultaneously?

Yes, but avoid overlapping subscriptions.

Q3: Do free apps really work?

Free apps provide basic budgeting, but premium features unlock advanced insights.

Q4: Can apps help me reduce debt?

Yes, apps with debt management and payment reminders are highly effective.

Conclusion: Choosing the Right Personal Finance App for Your Needs

Selecting the best personal finance app in the USA depends on your financial goals, tech comfort, and budget. Free apps suffice for basic tracking, while premium apps offer advanced insights, automated features, and investment monitoring. By carefully evaluating features and costs, users can achieve financial stability, reduce unnecessary spending, and plan for future wealth growth.