Small Business Loans in USA: Your Complete Guide to Funding and Growth

Introduction

Starting or growing a small business in the USA can be both exciting and challenging. With rising operational costs, fluctuating market conditions, and increased competition, securing reliable financing is often the difference between success and struggle. Small Business Loans in USA! Small business loans provide entrepreneurs with essential capital to manage day-to-day expenses, invest in growth, and maintain financial stability.

In recent years, the cost of running a small business has surged due to inflation, higher employee wages, and increased overhead. Business owners are constantly seeking solutions to offset these rising costs without compromising quality or operational efficiency. Small business loans are an attractive option, allowing owners to fund critical needs like inventory, marketing campaigns, or equipment upgrades. Personal Loans for Bad Credit in Canada

Affordability is key. Choosing the right type of small business loan ensures that the repayment terms align with cash flow and revenue projections. By understanding loan options, interest rates, and lender requirements, entrepreneurs can make informed decisions that help their businesses thrive in the competitive US marketplace.

What are Small Business Loans and Why Do They Matter?

Small business loans are financial products designed specifically to help business owners access capital. Unlike personal loans, these loans focus on supporting business growth, operational stability, and financial planning. They are vital because they provide the funding needed to cover everything from daily operations to large expansion projects. Personal Loans in the UK

Financial Benefits: Small business loans allow owners to invest in equipment, hire employees, or increase inventory without depleting cash reserves. This can improve profitability, reduce stress on personal finances, and create opportunities for long-term growth.

Legal and Regulatory Considerations: Loans provide a formalized framework for borrowing, which can help businesses manage tax obligations and maintain a clear financial record. Many lenders also report loan activity to credit bureaus, helping businesses build a strong credit profile. Best Homeowners Insurance Providers 2025

Peace of Mind: Knowing that funds are available for emergencies or unexpected expenses provides entrepreneurs with confidence. A well-structured loan allows businesses to weather temporary downturns without jeopardizing operations.

How Do Small Business Loans Work? Options for New Entrepreneurs

Small business loans operate through a straightforward lending process. Borrowers apply with a lender, provide necessary documentation, and, if approved, receive a loan amount to be repaid over a specified period with interest. However, new entrepreneurs often wonder which type of loan fits their situation best. YNAB vs Mint vs EveryDollar

Startups and First-Time Owners: For those just starting out, microloans or SBA-backed loans are ideal. These loans often require less collateral and have flexible repayment terms. Startups can use these funds to purchase initial inventory, set up office space, or cover marketing costs.

Young Entrepreneurs: Young business owners may qualify for programs targeting minority or youth-led enterprises. These programs often offer lower interest rates and mentorship resources to increase the likelihood of business success.

Flexible Loan Options: Many lenders provide lines of credit, term loans, or invoice financing. Lines of credit allow business owners to borrow only what they need when they need it, reducing interest costs. Term loans provide a lump sum upfront with fixed monthly payments, ideal for large capital expenses. Private Health Insurance Comparison

Alternative Lenders: Fintech companies have emerged as viable options for entrepreneurs who may not meet traditional bank criteria. Online lenders often have faster approval times, simplified applications, and less stringent credit requirements, making them attractive for first-time borrowers.

How Much Do Small Business Loans Cost?

The cost of a small business loan depends on multiple factors, including interest rates, loan type, repayment period, and lender policies. Here’s a general breakdown: Best Stock Trading Platforms 2025

| Loan Type | Typical APR | Average Term | Fees |

|---|---|---|---|

| SBA 7(a) Loan | 6%–12% | 7–25 years | 1%–3% guarantee fee |

| Term Loan | 7%–15% | 1–5 years | Origination fee 1%–5% |

| Line of Credit | 5%–20% | Revolving | Maintenance fees 1%–2% |

| Microloan | 8%–13% | Up to 6 years | Minimal origination fees |

| Invoice Financing | 8%–20% | Short-term | 1%–5% service fee |

Interest rates vary based on creditworthiness, collateral, and market conditions. Businesses with strong credit and financials often qualify for lower rates, while riskier borrowers may face higher costs.

Types of Small Business Loans in the USA

-

SBA Loans: Government-backed loans offering low rates and long repayment terms, ideal for startups and expanding businesses. Cheapest Car Insurance Companies 2025

-

Term Loans: Lump-sum loans repaid over a fixed period with set interest rates, suitable for equipment purchases or renovations.

-

Business Lines of Credit: Flexible borrowing up to a predetermined limit, perfect for cash flow management.

-

Invoice Financing: Advances based on outstanding invoices, providing immediate liquidity.

-

Merchant Cash Advances: Lenders provide cash upfront in exchange for a percentage of daily credit card sales.

-

Equipment Financing: Specific loans to purchase machinery or technology with collateral tied to the equipment.

-

Microloans: Small loans (usually under $50,000) targeted at startups or underserved businesses. Cheap Health Insurance Quotes Online

-

Personal Loans for Business Use: Sometimes entrepreneurs use personal loans for small business expenses, though this carries higher risk.

Top Companies and Lenders Offering Small Business Loans in the USA

-

SBA (Small Business Administration): Offers various programs with low-interest rates and long terms.

-

Bank of America: Known for tailored small business lending with flexible repayment options.

-

Wells Fargo: Offers lines of credit, term loans, and equipment financing.

-

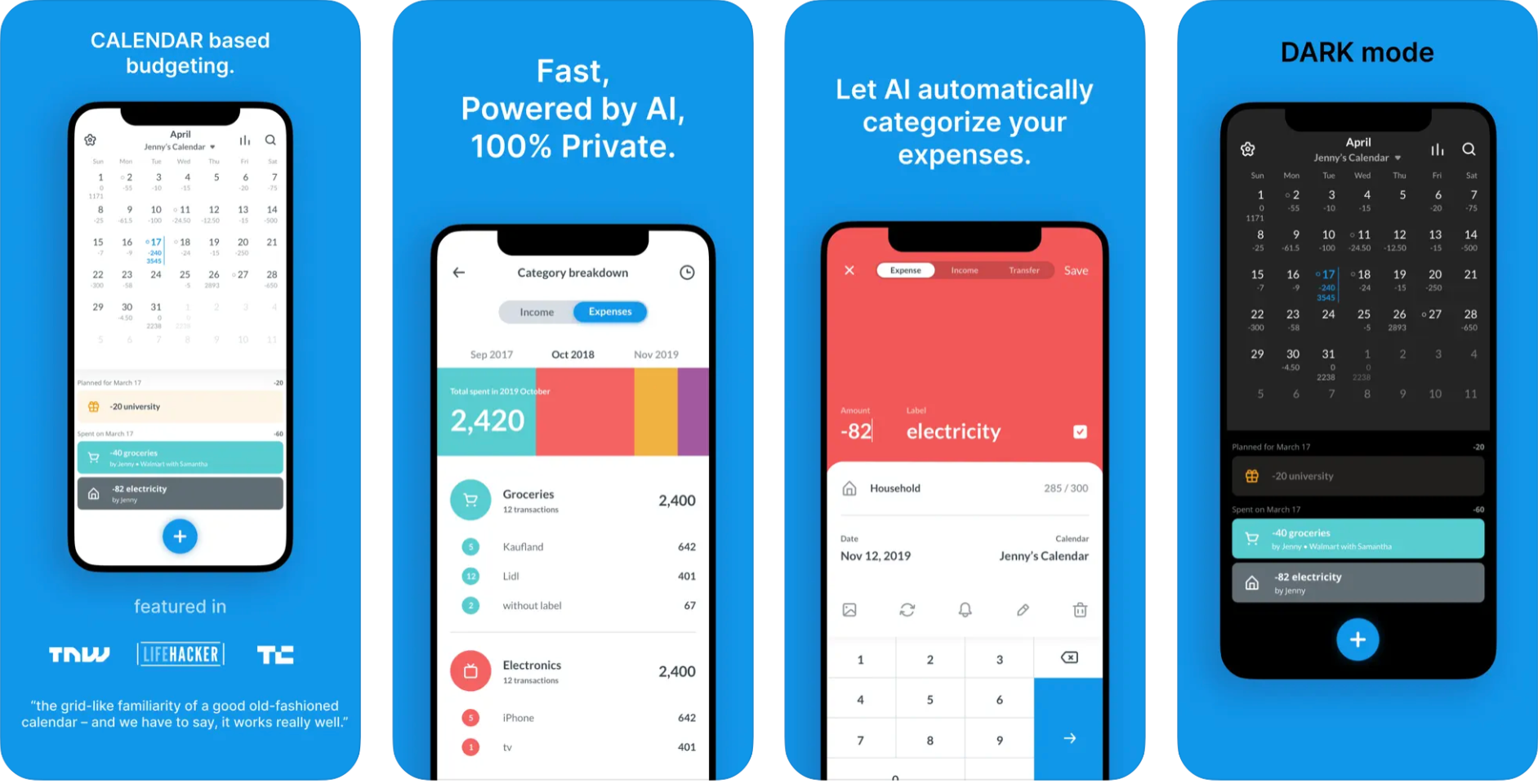

Chase: Provides small business lending with competitive rates and online management tools. Best Budgeting Apps 2025

-

BlueVine: Specializes in lines of credit and invoice financing for small businesses.

-

OnDeck: Offers term loans and lines of credit with fast online approval.

-

Kabbage: Flexible, online-focused lending for quick access to capital.

-

Regional Lenders & Credit Unions: Often provide personalized service and competitive rates, particularly in local markets.

What’s Typically Covered by a Small Business Loan?

Small business loans generally cover:

-

Working Capital: Payroll, rent, utilities, and day-to-day operations.

-

Equipment & Inventory: Purchase or lease of machinery, technology, or supplies. Best Personal Finance Software for Families in 2025

-

Expansion Costs: Opening new locations, marketing campaigns, or hiring additional staff.

-

Debt Consolidation: Paying off high-interest debts to improve cash flow.

-

Emergency Expenses: Covering unforeseen events or temporary cash flow shortages.

What’s Not Typically Covered by a Small Business Loan?

Lenders usually restrict funding for:

-

Personal Expenses: Owner’s personal debt or lifestyle costs.

-

Speculative Investments: High-risk ventures like gambling or cryptocurrency trading.

-

Illegal Activities: Any business activity violating federal or state law.

-

Excessive Risk Ventures: Unproven business models with no track record may be excluded.

Average Loan Amounts and Costs Across the USA

| Loan Type | Average Amount | Average APR | Typical Term |

|---|---|---|---|

| SBA Loan | $350,000 | 7%–9% | 7–25 years |

| Term Loan | $100,000 | 8%–12% | 1–5 years |

| Line of Credit | $50,000 | 5%–15% | Revolving |

| Microloan | $15,000 | 8%–13% | Up to 6 years |

Benefits of Choosing the Right Small Business Loan

-

Provides cash flow support without dipping into savings.

-

Helps expand operations or invest in growth opportunities.

-

Builds business credit, which can improve future borrowing terms.

-

Offers flexibility in repayment, especially with lines of credit.

Challenges of Getting a Small Business Loan

-

High interest rates for riskier borrowers.

-

Strict documentation requirements such as tax returns, financial statements, and collateral.

-

Trade-offs between loan size and repayment terms.

-

Potential risk of default, impacting credit score and future funding opportunities.

Is a Small Business Loan Worth It?

Loans are worth it when used strategically. They provide capital for growth, operational stability, and emergency planning. However, entrepreneurs must weigh interest rates, repayment terms, and potential impact on cash flow to ensure the loan contributes positively to long-term business goals.

Application Requirements and Documents Needed for Small Business Loans

-

Business registration and licenses

-

Employer Identification Number (EIN)

-

Financial statements (profit & loss, balance sheet)

-

Personal and business tax returns

-

Bank statements

-

Business plan outlining loan use

-

Collateral documentation (if required)

Top Regions in the USA with the Best Access to Small Business Loans

| State | Reason for Lower Barriers |

|---|---|

| California | High lender presence, supportive startup ecosystem |

| Texas | Business-friendly policies and access to SBA loans |

| New York | High concentration of financial institutions |

| Florida | Strong small business community and regional banks |

| Illinois | Multiple local credit unions offering tailored loans |

| Georgia | Growing tech and startup hubs |

| Massachusetts | Access to grants and microloan programs |

| Washington | Regional support and fintech options |

| Colorado | Favorable lending environment and SBA programs |

| North Carolina | Entrepreneurial support programs and low-cost lenders |

Small Business Loan Affordability vs. Business Revenue

| State | Avg. Small Business Revenue | Avg. Loan Payment (Annual) | Loan-to-Revenue Ratio |

|---|---|---|---|

| California | $500,000 | $35,000 | 7% |

| Texas | $450,000 | $30,000 | 6.7% |

| New York | $520,000 | $40,000 | 7.7% |

| Florida | $400,000 | $28,000 | 7% |

| Illinois | $380,000 | $25,000 | 6.5% |

Step-by-Step Guide: How to Apply for a Small Business Loan in the USA

-

Research Lenders: Compare banks, online lenders, and SBA options.

-

Prepare Documents: Gather financial statements, tax returns, business licenses, and collateral info.

-

Compare Loan Offers: Look at interest rates, terms, fees, and repayment schedules.

-

Apply Online or In-Person: Submit applications with complete documentation.

-

Approval & Funding: Lenders review, may request additional info, then disburse funds.

Websites and Tools to Find the Best Small Business Loans in the USA

-

SBA.gov: Official government resource for SBA loans.

-

Lendio.com: Online marketplace for loan comparison.

-

Fundera.com: Helps compare loan options for startups and growing businesses.

-

Bank Websites: Chase, Wells Fargo, Bank of America – online applications and tools.

-

Fintech Apps: Kabbage, BlueVine, OnDeck – fast approvals and flexible options.

FAQs about Small Business Loans in the USA

Q1: Can I get a loan with bad credit?

A1: Yes, alternative lenders may approve loans for lower credit scores, though interest rates are higher.

Q2: How long does approval take?

A2: Traditional banks: 2–6 weeks. Online lenders: 24–72 hours.

Q3: Do I need collateral?

A3: Some loans require collateral; SBA loans may have flexible collateral requirements.

Q4: Can I use a personal loan for business?

A4: Possible, but it carries higher risk and may not be ideal for larger financing needs.

Q5: Are SBA loans worth it?

A5: Yes, they offer lower interest rates and longer terms, especially for startups and growing businesses.

Conclusion: Choosing the Right Small Business Loan for Your Growth

Selecting the right small business loan in the USA is critical for financial stability and growth. Entrepreneurs must consider loan type, interest rates, repayment terms, and eligibility requirements. By researching options, preparing documents, and comparing lenders, business owners can secure financing that aligns with operational goals and long-term growth strategies.