Personal Loans for Bad Credit in Canada: A Complete Guide

Introduction

Over the last decade, the financial landscape in Canada has shifted dramatically. Rising inflation, increased housing costs, and day-to-day living expenses have placed greater pressure on household budgets. Personal Loans for Bad Credit in Canada For many Canadians, credit cards and personal loans have become essential tools to cover emergencies, consolidate debt, or manage financial shortfalls. But what happens when your credit score is less than ideal? Personal Loans in the UK

Bad credit can make borrowing feel impossible. Traditional banks often decline applications from individuals with lower credit scores, leaving them without access to much-needed funds. Yet the reality is that millions of Canadians face financial setbacks every year—job loss, illness, or unexpected expenses—that impact their credit histories.

This is where personal loans for bad credit in Canada come into play. These loans are specifically designed for borrowers with less-than-perfect credit scores, giving them an opportunity to access funds while rebuilding their financial profiles. Understanding how they work, their costs, and which lenders to consider is essential before applying. Best Homeowners Insurance Providers

What Are Personal Loans for Bad Credit in Canada?

A personal loan for bad credit is a type of financing offered to individuals whose credit scores fall below the threshold that traditional banks usually require. Instead of focusing solely on credit history, these loans may consider income stability, employment status, or collateral.

The purpose of these loans is twofold: YNAB vs Mint vs EveryDollar

-

Access to funds – for debt consolidation, medical bills, home repairs, or emergencies.

-

Financial peace of mind – knowing that there are options available even when mainstream banks say no.

From a financial perspective, they provide liquidity when it’s needed most. From a legal perspective, they are regulated under Canadian lending laws, ensuring transparency in terms of interest rates and fees. And from a peace-of-mind perspective, they allow borrowers to manage urgent needs without resorting to unregulated lending sources.

How Do Personal Loans for Bad Credit Work in Canada?

Unlike standard personal loans, bad credit loans come with higher risks for lenders. As a result, the terms and conditions are structured differently. Private Health Insurance Comparison

-

Interest Rates – Borrowers can expect annual percentage rates (APRs) ranging from 19% to 47%, depending on the lender and loan type. This is significantly higher than bank-issued personal loans for good credit borrowers, which typically range between 6% to 12%.

-

Loan Amounts – Bad credit loans usually range from $500 to $15,000, depending on income, collateral, and lender policies.

-

Repayment Terms – Loan durations may span from a few months to five years. Shorter repayment terms often come with higher monthly payments, while longer terms reduce monthly obligations but increase overall interest paid.

-

Options Available:

-

Secured personal loans – require collateral such as a car or home equity.

-

Unsecured personal loans – no collateral but higher rates.

-

Co-signed loans – involve a guarantor with stronger credit.

-

Alternative lenders – online platforms and credit unions with more flexible requirements. Best Stock Trading Platforms

-

For students, first-time borrowers, and young Canadians, these loans can serve as a stepping stone toward financial independence. While they cost more, they provide an opportunity to build a stronger repayment history if managed responsibly.

How Much Do Personal Loans for Bad Credit Cost in Canada?

The cost of borrowing depends on several factors:

-

Average APRs: 19%–47%.

-

Administrative fees: Application fees, loan origination charges, and late payment penalties. Cheapest Car Insurance Companies

-

Regional Differences: Loan affordability varies across provinces due to local regulations and competition among lenders. For instance, Ontario and British Columbia have higher lending competition compared to smaller provinces like Newfoundland and Labrador.

A $5,000 loan at 29% APR repaid over 36 months could cost more than $2,500 in interest alone. This makes careful comparison shopping crucial before committing.

Types of Personal Loans for Bad Credit in Canada

Borrowers should understand the different loan products available:

-

Secured Loans – backed by collateral, usually offering lower rates than unsecured loans.

-

Unsecured Loans – require no collateral but come with higher rates and stricter terms.

-

Payday Loans – short-term, high-interest loans (often exceeding 400% APR). These are risky and should only be considered as a last resort. Cheap Health Insurance Quotes Online

-

Installment Loans – structured repayments over several months or years, making them easier to budget.

-

Debt Consolidation Loans – combine multiple debts into one payment, potentially reducing interest costs.

-

Credit Union Loans – often more affordable than payday lenders, with community-based approval processes.

Top Lenders Offering Personal Loans for Bad Credit in Canada

Here are some well-known providers that offer financing for Canadians with poor credit:

-

LoanConnect – Canada’s leading online loan search platform, connecting borrowers with multiple lenders.

-

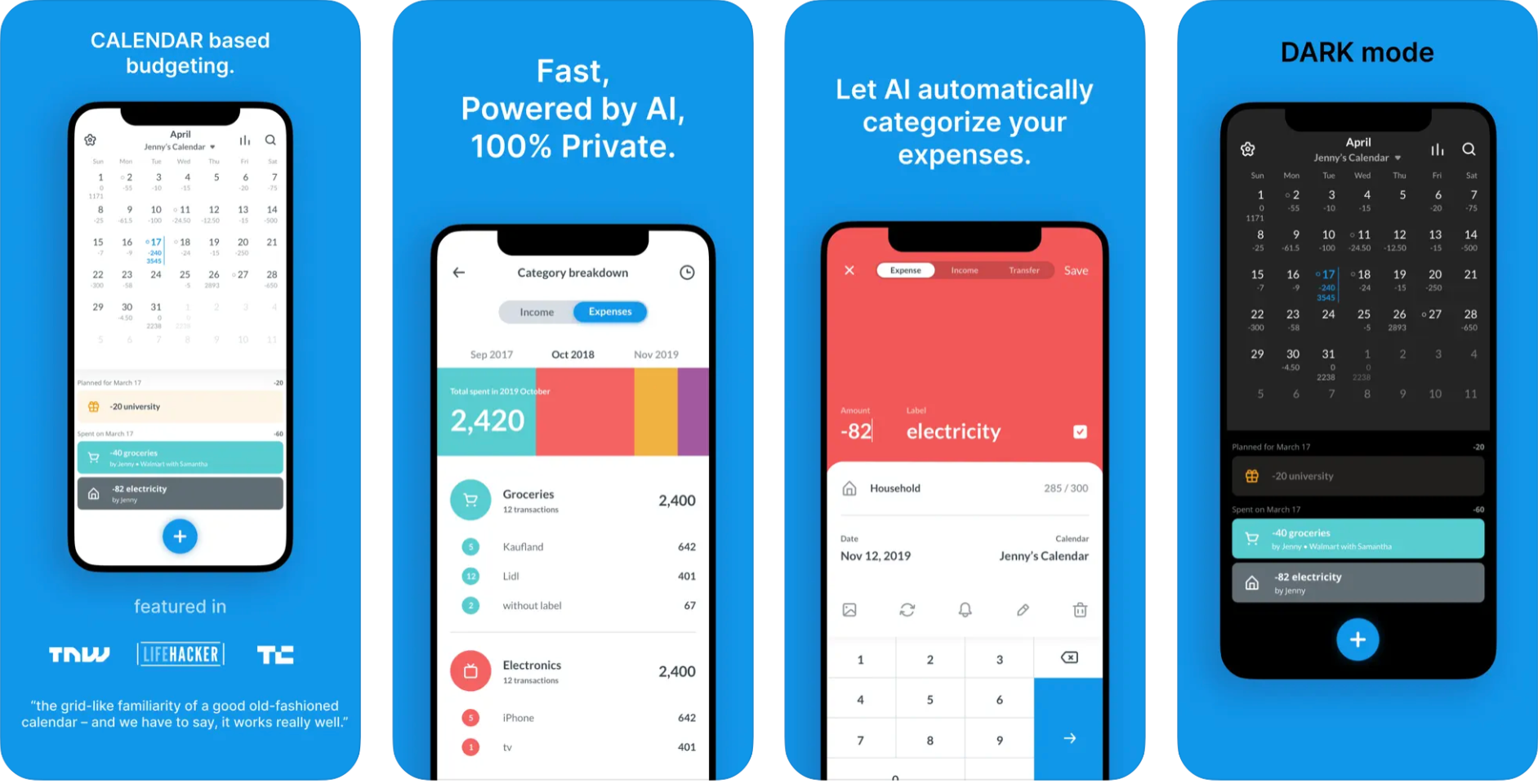

Fairstone – offers secured and unsecured personal loans up to $50,000 with flexible repayment terms. Best Budgeting App

-

SkyCap Financial – caters specifically to borrowers with lower credit scores.

-

Borrowell – provides personal loans while also offering free credit monitoring.

-

EasyFinancial – a non-bank lender known for flexible approval processes.

-

Local Credit Unions – many provincial credit unions provide personal loans to members, sometimes at lower rates than national lenders.

What’s Typically Covered by Personal Loans in Canada?

Bad credit personal loans can be used for:

-

Debt consolidation.

-

Medical or emergency expenses.

-

Car purchases or repairs. Best Personal Finance Software for Families

-

Home improvements.

-

Education or training programs.

-

Moving costs or relocation expenses.

What’s Typically Not Covered by Personal Loans in Canada?

While flexible, personal loans generally cannot be used for:

-

Illegal activities.

-

High-risk investments such as gambling.

-

Mortgage down payments (most lenders restrict this).

-

Business capital (unless explicitly allowed by the lender).

Benefits of Choosing a Personal Loan for Bad Credit in Canada

-

Access to Credit – even when traditional banks decline.

-

Credit Building – responsible repayments can improve credit scores.

-

Flexible Use – unlike car loans or mortgages, funds can be used for multiple needs.

-

Debt Management – consolidating multiple high-interest debts into one loan with a fixed payment.

Challenges of Personal Loans for Bad Credit in Canada

-

High Interest Rates – borrowers can pay double or triple compared to prime borrowers.

-

Shorter Terms – increases monthly repayment burden.

-

Risk of Debt Trap – borrowing repeatedly without improving financial stability.

-

Collateral Risk – in secured loans, borrowers risk losing their assets.

Is a Personal Loan for Bad Credit Worth It in Canada?

It depends. For borrowers facing urgent needs or those committed to improving credit, it can be a lifeline. However, for individuals who already struggle to make ends meet, taking on new debt may worsen their financial situation.

Alternatives include:

-

Borrowing from credit unions.

-

Using a secured credit card to rebuild credit.

-

Seeking financial counseling.

-

Exploring government assistance programs.

Application Requirements and Documents

Most lenders will ask for:

-

Proof of identity (passport, driver’s license).

-

Proof of income (pay stubs, tax returns, bank statements).

-

Employment verification.

-

Proof of residence.

-

Collateral documents (for secured loans).

Top Regions in Canada with the Most Affordable Loan Options

-

Ontario – largest lender competition, more fintech providers.

-

British Columbia – growing number of online lenders.

-

Alberta – competitive due to higher household incomes.

-

Quebec – strong presence of credit unions (caisses populaires).

-

Atlantic Canada – fewer lenders, but some community-based options.

Income vs. Loan Repayment Comparison: Affordability Across Canada

| Province | Avg Household Income | Avg Loan Repayment (per $5,000 @ 29% APR, 36 months) | Loan Burden % |

|---|---|---|---|

| Ontario | $100,000 | $232/month | 2.8% |

| British Columbia | $92,000 | $232/month | 3.0% |

| Alberta | $110,000 | $232/month | 2.5% |

| Quebec | $85,000 | $232/month | 3.3% |

| Atlantic Canada | $75,000 | $232/month | 3.7% |

How to Apply for a Personal Loan for Bad Credit in Canada

-

Research Lenders – check banks, credit unions, and online lenders.

-

Compare Loan Offers – interest rates, terms, and fees.

-

Prepare Documents – proof of income, ID, and bank statements.

-

Submit Application – online or in person.

-

Wait for Approval – typically within 24–72 hours for online lenders.

-

Receive Funds – direct deposit once approved.

-

Begin Repayment – follow the repayment schedule strictly to rebuild credit.

Websites and Tools to Find Personal Loans for Bad Credit in Canada

-

LoanConnect – compares multiple lenders in one application.

-

Borrowell – offers credit monitoring and loan matching.

-

Ratehub.ca – Canadian comparison platform.

-

Credit Karma – free credit score monitoring and lender suggestions.

-

Bank/credit union calculators – help estimate affordability.

FAQs about Personal Loans for Bad Credit in Canada

Q: Can I get approved with no income?

Most lenders require proof of income. Some may consider government benefits or co-signers.

Q: Do personal loans improve my credit score?

Yes—if payments are made on time, they can gradually rebuild credit.

Q: How fast can I get funds?

Some online lenders deposit funds within 24 hours. Traditional lenders may take a few days.

Q: Can I apply with a co-signer?

Yes, this increases approval chances and can reduce interest rates.

Conclusion

Accessing credit with bad credit in Canada is challenging—but not impossible. Personal loans designed for low-credit borrowers provide a pathway to financial relief, whether for emergencies, debt consolidation, or essential expenses.

The key is responsibility: comparing lenders, understanding costs, and ensuring repayment is manageable. With the right loan, Canadians with bad credit can not only meet their immediate needs but also rebuild their credit scores for a more stable financial future.