Best Stock Trading Platforms 2025

Introduction

The world of investing has transformed dramatically in the last decade. With the rise of commission-free trading apps, advanced brokerage platforms, and AI-powered tools, more people than ever before are exploring stock trading. In 2025, retail investors face both opportunities and challenges as they navigate volatile markets, increasing competition, and a growing variety of trading platforms. Choosing the best stock trading platform can determine whether investors succeed in building long-term wealth or struggle with high fees, poor execution, and limited tools. Cheapest Car Insurance Companies 2025

The rising cost of living, inflation pressures, and tighter budgets mean affordability is a key consideration when selecting a trading platform. Investors not only want the best features and security but also platforms that align with their financial goals without eating into profits through hidden charges. Whether you are a beginner, student, or seasoned investor, the right choice can save money while providing valuable insights and trading flexibility.

This article dives deep into the best stock trading platforms in 2025, covering costs, types of platforms, benefits, drawbacks, requirements, and global perspectives. By the end, you’ll have a clear roadmap for selecting the ideal platform that balances affordability, security, and performance. Cheap Health Insurance Quotes Online

What Are the Best Stock Trading Platforms in 2025?

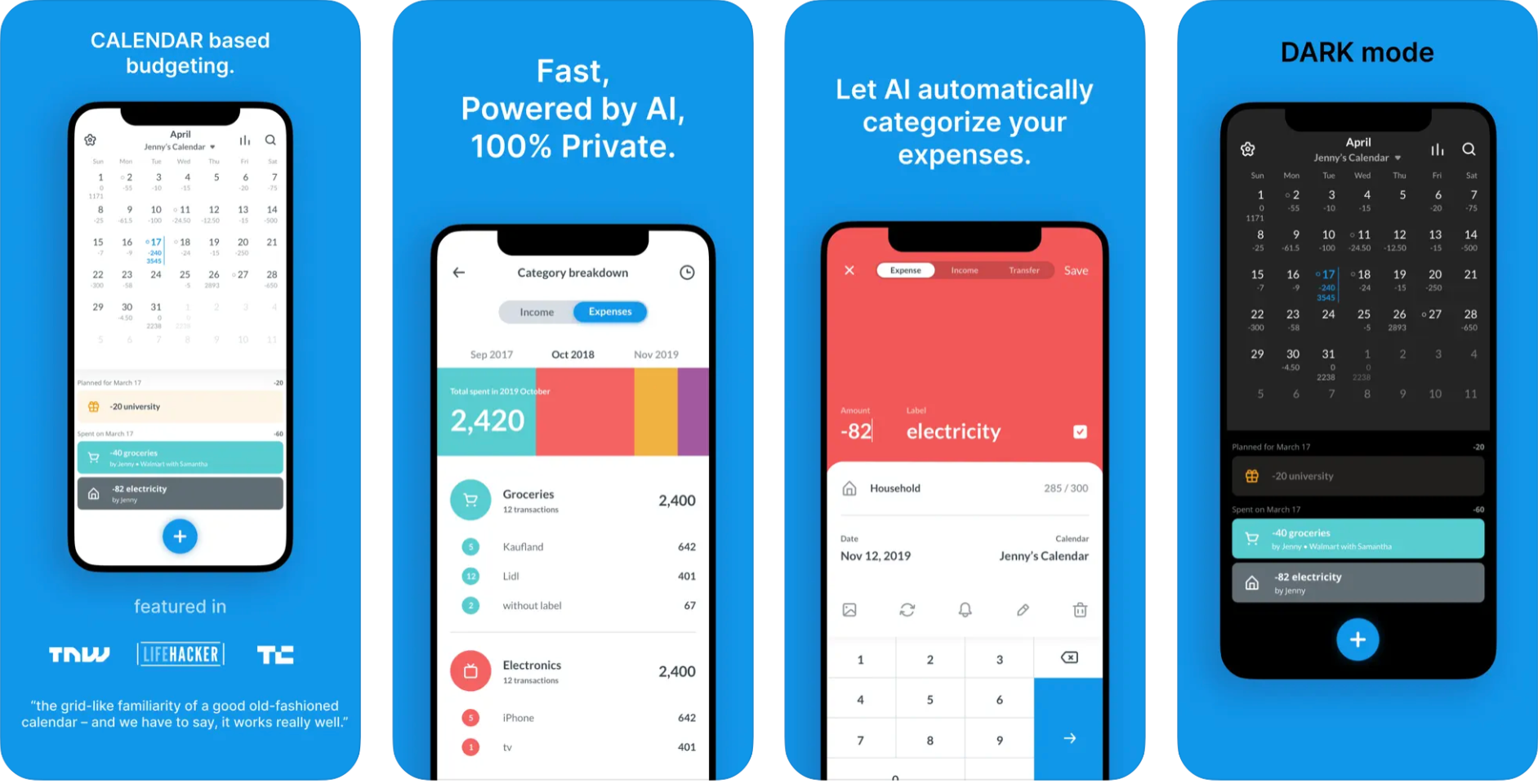

The best stock trading platforms in 2025 combine cutting-edge technology, cost efficiency, and user-friendly design. They aren’t just digital brokers — they are complete ecosystems offering access to global markets, real-time data, advanced analytics, and learning resources. Best Budgeting Apps 2025

Financially, a reliable platform ensures fair pricing on trades and helps minimize costs like spreads, subscription fees, or hidden charges. Legally, trustworthy brokers operate under regulations such as SEC (U.S.), FCA (U.K.), or ASIC (Australia), providing peace of mind to traders. Beyond compliance, investors seek platforms that protect their data, funds, and investments through strong cybersecurity and insurance measures. Best Personal Finance Software for Families in 2025

Ultimately, the “best” depends on the trader. Beginners may value simplicity and education, while professionals prioritize advanced tools and global market access. In 2025, hybrid platforms catering to multiple investor profiles are emerging as the top contenders.

How Do Stock Trading Platforms Work? Options for Beginners and New Investors

Stock trading platforms act as the gateway between investors and financial markets. At their core, they provide the infrastructure for buying and selling stocks, ETFs, options, and sometimes cryptocurrencies.

For beginners, platforms like Robinhood, Webull, and eToro have made stock trading accessible with commission-free trades, low account minimums, and simplified interfaces. Students and young investors can start with as little as $10–$50, gaining exposure to markets without heavy financial commitments.

For new investors, user-friendly mobile apps are often the first step. These platforms guide users with interactive tutorials, demo accounts, and educational libraries. Some also provide AI-driven investment recommendations that suggest diversified portfolios based on risk tolerance.

Meanwhile, traditional full-service brokers such as Fidelity, Charles Schwab, and TD Ameritrade remain strong players, offering both robust platforms for active traders and advisory services for those seeking expert guidance. The key is that modern platforms are flexible — they allow both self-directed investing and passive approaches like automated robo-advisors.

In short, platforms in 2025 cater to different needs: convenience for casual investors, powerful tools for day traders, and hybrid solutions for those seeking both.

How Much Do Stock Trading Platforms Cost?

The cost of using a stock trading platform varies widely depending on the provider, type of account, and services included.

-

Commissions: Most platforms now offer commission-free trading on U.S. stocks and ETFs. However, fees may still apply to options contracts, mutual funds, or international trades.

-

Spreads & Hidden Costs: Some brokers compensate for “free trades” by widening bid-ask spreads or charging higher fees on margin loans.

-

Account Minimums: While apps like Robinhood require no minimum deposit, others such as Interactive Brokers may require $100–$1,000 to unlock advanced features.

-

Subscriptions: Premium tiers may charge $5–$30 per month for advanced analytics, real-time market data, or professional charting.

-

Miscellaneous Fees: Inactivity fees, wire transfers, withdrawal fees, or currency conversion costs can add up.

On average, beginners in 2025 can expect annual platform costs between $50–$300, while active traders who pay for premium features may spend upwards of $1,000 annually.

Types of Stock Trading Platforms in 2025

The stock trading platform landscape in 2025 includes multiple categories:

-

Full-Service Brokers: Fidelity, Schwab — comprehensive tools, research, financial advisors.

-

Discount Brokers: E*TRADE, TD Ameritrade — cost-effective with strong trading tools.

-

Mobile-First Apps: Robinhood, Webull, Public — easy-to-use, commission-free, ideal for beginners.

-

AI-Powered Platforms: QuantConnect, Trade Ideas — machine learning for trade recommendations.

-

Robo-Advisors: Betterment, Wealthfront — automated, hands-off investing.

-

Crypto-Inclusive Brokers: Interactive Brokers, eToro — allow both traditional stock and crypto trading.

Each type serves different needs: from passive investors wanting simplicity, to professional traders requiring advanced analytics.

Top Companies Offering the Best Stock Trading Platforms 2025

Here are the leading stock trading platforms in 2025:

-

Fidelity Investments – Best for research, retirement planning, and beginner education.

-

Charles Schwab – Comprehensive, no-fee structure, powerful for both beginners and experts.

-

TD Ameritrade (Thinkorswim) – Advanced charting, paper trading, active traders’ favorite.

-

E*TRADE – Balanced platform with both beginner-friendly and advanced tools.

-

Robinhood – Popular among younger traders, known for mobile-first simplicity.

-

Webull – Strong charting features and options trading with no commissions.

-

Interactive Brokers – Best for global access and professionals.

-

eToro – Known for social trading and crypto integration.

-

Public – Commission-free trading with a community-driven approach.

-

SoFi Invest – Best for beginners combining investing with personal finance.

What’s Typically Included in a Stock Trading Platform?

Most best stock trading platforms in 2025 include:

-

Real-time quotes and live price tracking

-

Trading execution across stocks, ETFs, and options

-

Research tools and stock screeners

-

Technical charting and analytics

-

Mobile and desktop access

-

Paper trading/demo accounts

-

Educational content and tutorials

-

Customer support via chat, phone, or email

These inclusions ensure that both beginners and experts can maximize their trading experience.

What’s Not Included in Most Stock Trading Platforms?

Despite improvements, certain features are often missing or locked behind paywalls:

-

Personalized financial advice

-

Premium market data (Level II quotes, international exchanges)

-

Tax optimization tools for global users

-

Guaranteed order execution speed

-

High-touch customer service (usually only for high-net-worth accounts)

Investors should check carefully what’s included before committing.

Benefits of Choosing the Best Stock Trading Platforms 2025

-

Cost Savings: Commission-free trades mean more profit retention.

-

Advanced Tools: AI-driven insights and professional charting improve decision-making.

-

Flexibility: Access to stocks, ETFs, options, and sometimes crypto in one place.

-

Education: Beginner-friendly tutorials and demo accounts reduce risk.

-

Global Reach: Ability to trade international markets from one account.

Challenges of Choosing the Wrong Stock Trading Platform

-

Hidden Costs: “Free” trading may mask higher spreads or withdrawal fees.

-

Limited Coverage: Some platforms restrict access to only U.S. stocks.

-

Customer Service Issues: Delays in withdrawals or lack of live support can frustrate users.

-

Over-Simplification: Beginner apps may lack advanced features for growth.

-

Security Concerns: Lesser-known apps may not offer sufficient fund protection.

Is Premium Access or Paid Subscriptions Worth It?

For active traders, premium subscriptions can be worth the cost. Paying for advanced market data, AI-powered screeners, or faster execution can make the difference in profitability. However, for casual investors, free tiers with basic tools are often enough. The decision depends on trading frequency, strategy, and financial goals.

Requirements and Documents Needed to Open a Trading Account

To open an account on the best stock trading platforms 2025, you’ll typically need:

-

Government-issued ID (passport, driver’s license)

-

Social Security Number or Tax Identification Number

-

Proof of residence (utility bill, bank statement)

-

Bank account details for deposits/withdrawals

-

Employment information (for compliance and anti-money laundering checks)

Top 10 Countries/Regions with the Best Stock Trading Platforms

-

United States – Most competitive platforms and free trading options.

-

United Kingdom – FCA-regulated brokers with strong investor protections.

-

Canada – Blend of banks and fintech brokers.

-

Singapore – Gateway to Asian markets.

-

Australia – ASIC-regulated with diverse global access.

-

Germany – Advanced fintech platforms integrated with EU markets.

-

India – Growing retail investor base and discount brokers like Zerodha.

-

Japan – Reliable, tech-driven brokers.

-

Hong Kong – Access to both Chinese and global stocks.

-

UAE – Emerging fintech hub with access to global investments.

Income vs. Investment Costs: How Affordable Platforms Impact Traders’ Budgets

| Country | Avg Annual Income (USD) | Avg Platform Fees (USD) | % of Income |

|---|---|---|---|

| U.S. | $65,000 | $200 | 0.3% |

| U.K. | $48,000 | $250 | 0.5% |

| Canada | $52,000 | $220 | 0.4% |

| India | $7,500 | $50 | 0.7% |

| Australia | $60,000 | $280 | 0.4% |

This table shows affordability depends on both local income and broker pricing.

How to Open an Account on the Best Stock Trading Platforms 2025

-

Research – Compare features, costs, and regulations.

-

Choose a Platform – Pick one aligned with your goals.

-

Register – Provide personal details and verify identity.

-

Fund Account – Link bank account, deposit funds.

-

Explore Tools – Use demo accounts or tutorials.

-

Start Trading – Begin with small trades and scale gradually.

Websites and Tools to Compare the Best Stock Trading Platforms 2025

-

Investopedia Broker Comparison Tool

-

NerdWallet Broker Reviews

-

StockBrokers.com Annual Rankings

-

BrokerChooser.com

-

Mobile apps like Finder and SmartAsset

These resources help investors filter platforms based on fees, features, and user feedback.

FAQs About the Best Stock Trading Platforms 2025

Q: Which stock trading platform is best for beginners?

A: Robinhood, Webull, and SoFi Invest.

Q: Which platform has the lowest fees?

A: Fidelity and Charles Schwab for zero commissions.

Q: Which is best for active day traders?

A: Interactive Brokers and TD Ameritrade’s Thinkorswim.

Q: Which platforms allow crypto trading?

A: eToro, Interactive Brokers, Robinhood.

Q: Which platform is safest?

A: Regulated platforms like Fidelity, Schwab, and Interactive Brokers.

Conclusion: Getting the Right Platform for Your Investment Goals in 2025

In 2025, investors have more choices than ever. The best stock trading platforms balance affordability, security, and powerful tools. Beginners benefit from commission-free apps with educational support, while advanced traders gain from robust platforms with global reach.

The right decision depends on your goals: whether you seek low-cost simplicity, premium analytics, or international diversification. By comparing features, costs, and regulatory safeguards, you can select a platform that supports your financial journey while avoiding common pitfalls.

Choosing wisely ensures that every trade counts — not just for 2025, but for your long-term wealth-building goals.