Cheapest Car Insurance Companies 2025

Introduction

Car insurance has always been one of the most essential—and often expensive—financial products that drivers need to maintain. In 2025, rising living costs, inflation, and changes in driving patterns have pushed more households to search for ways to cut expenses. For many, auto insurance premiums can represent a significant portion of monthly budgets, making affordability more important than ever. That’s where finding the cheapest car insurance companies in 2025 becomes critical. Cheap Health Insurance Quotes Online

Car insurance is not just a legal requirement in most states and countries; it also protects drivers from financial ruin in case of accidents. But as premiums rise, many people are forced to balance the cost of staying insured with other household needs like rent, groceries, and utilities. Thankfully, competition among insurers and innovations such as usage-based policies have opened up more affordable options than before.

This guide takes a deep dive into the cheapest auto insurance providers available in 2025, exploring how car insurance works, what affects costs, and which companies deliver the best value. Whether you are a student, a first-time driver, or simply someone looking to trim expenses, understanding these options can help you save money without giving up essential coverage. Best Budgeting Apps 2025

What Are Car Insurance Companies and Why They Matter?

Car insurance companies exist to provide financial protection against risks associated with driving. In most regions, purchasing at least a basic liability insurance policy is a legal requirement before you can operate a vehicle. These companies pool risk: each driver pays a premium, and in return, the insurer promises to cover certain losses if an accident occurs. Best Personal Finance Software for Families in 2025

The importance of car insurance extends beyond compliance with the law. It provides:

-

Financial protection: Repairs after an accident or replacing a totaled car can cost thousands of dollars. Insurance cushions drivers from these unexpected expenses.

-

Legal compliance: Driving without insurance can result in hefty fines, license suspension, or even jail time.

-

Peace of mind: Having reliable coverage means you can focus on driving rather than worrying about every potential accident or liability.

In short, car insurance companies are the backbone of road safety and financial stability for millions of drivers. Choosing the right one—especially an affordable one—directly impacts household finances in 2025.

How Does Auto Insurance Work? Options for New Drivers

Auto insurance works on a simple principle: you pay a premium to an insurance company in exchange for protection against specific risks. If you’re involved in an accident or experience a covered loss, the insurer helps cover the costs according to your policy terms.

1. The Basics of Auto Insurance

Policies are usually structured around different types of coverage, such as liability, collision, and comprehensive. Each policy has limits (the maximum the insurer will pay) and deductibles (the amount you must pay before insurance kicks in).

2. Challenges for New Drivers

New drivers—especially students and young adults—face some of the highest insurance rates. Why? Insurers see them as “high risk” due to lack of experience, higher accident statistics, and sometimes inconsistent driving patterns.

3. Affordable Coverage for Students and First-Time Drivers

Many insurers now offer specialized programs to help younger drivers find cheaper options. Examples include:

-

Good student discounts (for maintaining high grades).

-

Telematics programs (tracking safe driving to earn discounts).

-

Parent-add-on policies (where young drivers join a family plan instead of getting standalone insurance).

4. Young People and Usage-Based Options

For budget-conscious young drivers, usage-based and pay-per-mile insurance options are often the cheapest. These programs charge lower premiums for those who drive less frequently or demonstrate safe driving habits through in-car devices or apps.

Understanding these options early can help new drivers save hundreds of dollars each year.

How Much Does Car Insurance Cost in 2025?

In 2025, the average cost of car insurance in the United States is between $1,600 and $2,200 annually for full coverage. Minimum liability-only coverage may cost as low as $500–$700 per year, depending on location and driving history.

Factors that influence car insurance costs include:

-

Age and driving experience: Younger drivers pay significantly more.

-

Location: Urban areas with higher accident rates usually have higher premiums.

-

Type of vehicle: Luxury cars, SUVs, and sports cars cost more to insure than economy sedans.

-

Driving record: Accidents, traffic violations, and DUI records can increase costs dramatically.

-

Credit score (in some states): Insurers sometimes use credit history as a risk indicator.

The good news is that comparing quotes and understanding your options can make premiums much more manageable.

Types of Auto Insurance Policies That Can Be Cheap

Not all car insurance policies are created equal. Some options are naturally more affordable than others:

-

Liability-Only Insurance: Covers damage to others but not your own car. Often the cheapest option, ideal for older cars.

-

Usage-Based Insurance: Rates are based on how you drive, tracked via telematics devices or apps.

-

Pay-Per-Mile Insurance: Best for low-mileage drivers, where premiums are tied to the actual miles driven.

-

Collision Coverage: Covers damages to your vehicle in an accident with another car or object. Usually pricier but essential for newer cars.

-

Comprehensive Coverage: Covers non-collision events like theft, fire, or natural disasters. While more expensive, shopping smart can make it affordable.

Choosing the right type depends on your vehicle’s value, driving habits, and budget.

Top Companies Offering the Cheapest Car Insurance in 2025

Several insurers stand out in 2025 for offering reliable coverage at lower rates:

-

GEICO – Known for low rates, especially for safe drivers and federal employees.

-

State Farm – Offers affordable options with extensive agent networks.

-

Progressive – Competitive for drivers with less-than-perfect records.

-

Allstate – Attractive bundling discounts for auto + home insurance.

-

USAA – Best for military members and their families (often the cheapest overall).

-

Regional Insurers – Companies like Erie Insurance, Auto-Owners, and Farm Bureau can be even cheaper in certain states.

What’s Typically Covered by Auto Insurance?

Most car insurance policies include coverage for:

-

Bodily injury liability

-

Property damage liability

-

Medical payments or personal injury protection (PIP)

-

Uninsured/underinsured motorist coverage

What’s Typically Not Covered by Auto Insurance?

Common exclusions include:

-

Normal wear and tear

-

Mechanical breakdowns

-

Ridesharing without special coverage

-

Using your car for business (unless specifically added)

Benefits of Choosing the Cheapest Auto Insurance

-

Significant cost savings

-

Flexibility for budget-conscious drivers

-

Ability to bundle with other policies for more discounts

Challenges of Buying the Cheapest Auto Insurance

-

Limited coverage options

-

Higher deductibles

-

Potential exclusions that leave gaps in protection

Application Requirements and Documents Needed for Auto Insurance

To apply, you’ll typically need:

-

Driver’s license

-

Vehicle registration

-

Proof of address

-

Driving history

-

Sometimes a credit check

Top 10 Countries, States, or Regions with the Cheapest Auto Insurance in 2025

Examples:

-

Maine – Low population density = fewer claims.

-

Idaho – Safer roads and lower repair costs.

-

Ohio – Highly competitive insurance market.

-

Vermont – Smaller population, fewer accidents.

-

North Carolina – Strong insurance regulations keeping costs low.

Salary vs. Premium Comparison: How Affordable Insurance Affects Household Budgets

| State | Avg Salary (2025) | Avg Annual Premium | % of Income Spent on Insurance |

|---|---|---|---|

| Maine | $58,000 | $1,000 | 1.7% |

| Idaho | $55,000 | $1,050 | 1.9% |

| Ohio | $60,000 | $1,200 | 2.0% |

| Vermont | $57,000 | $1,150 | 2.0% |

| North Carolina | $62,000 | $1,250 | 2.1% |

Step-by-Step Guide: How to Apply for the Cheapest Car Insurance

-

Research companies

-

Compare quotes

-

Check for discounts

-

Apply online or through an agent

-

Provide required documents

-

Make first payment and activate coverage

Websites and Tools to Find the Cheapest Auto Insurance

-

Comparison Sites: The Zebra, NerdWallet, Compare.com

-

Insurer Websites: GEICO, Progressive, State Farm

-

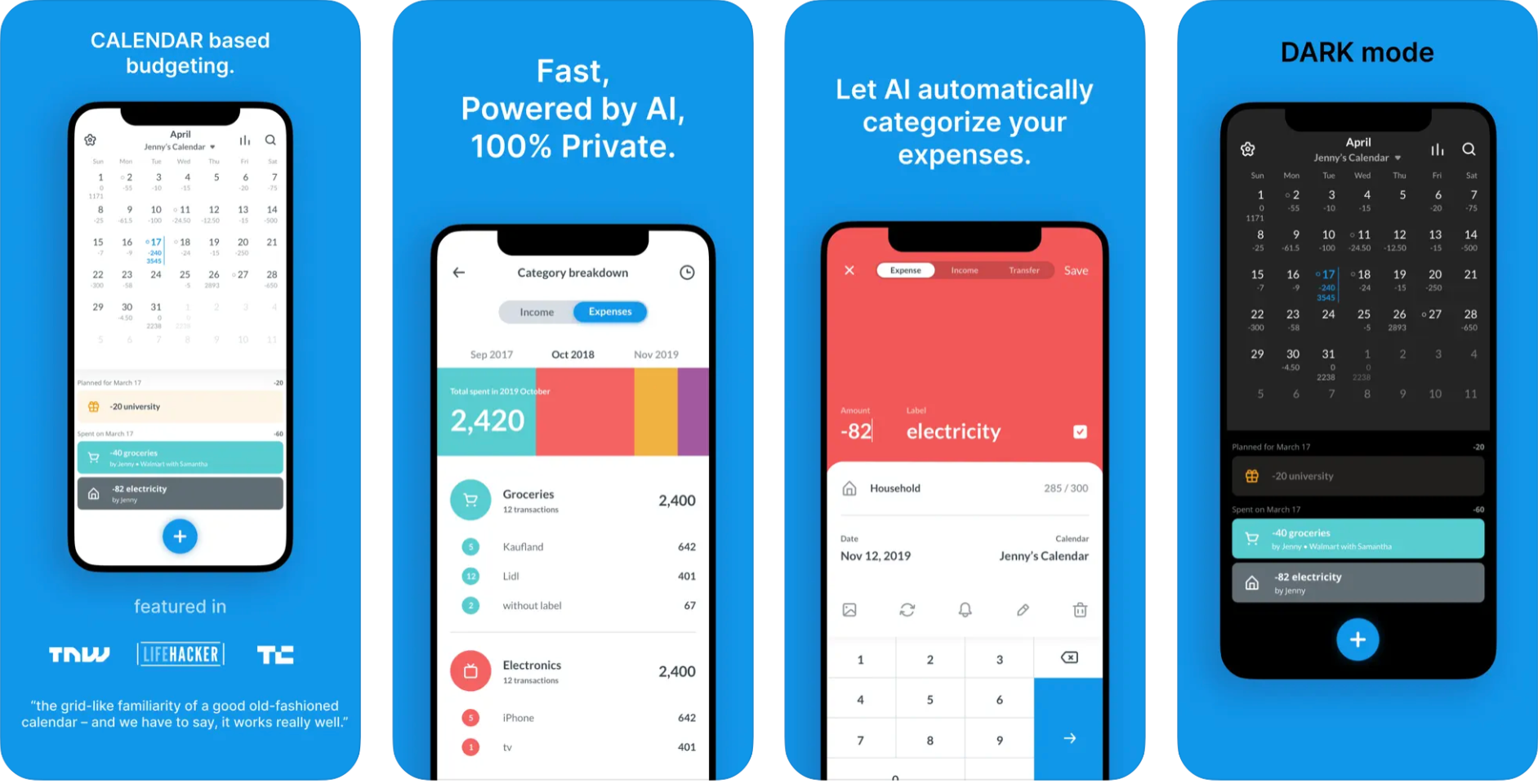

Mobile Apps: Root, Metromile, Jerry

FAQs About Cheapest Car Insurance Companies

Q: Who offers the cheapest car insurance in 2025?

A: GEICO and USAA are consistently among the lowest, though it depends on your state.

Q: Can I lower my premium quickly?

A: Yes—by raising deductibles, bundling policies, or improving your credit score.

Q: Do students really get discounts?

A: Absolutely. Many insurers offer 10–20% savings for good grades.

Conclusion on Cheapest Car Insurance Companies

Finding the cheapest car insurance companies in 2025 doesn’t mean you have to sacrifice quality. By understanding how insurance works, exploring affordable policy types, and comparing top providers, you can strike the perfect balance between cost and protection. The smartest approach is to shop around, leverage discounts, and ensure you’re not underinsured in pursuit of savings.

In the end, affordable car insurance is about more than just numbers—it’s about peace of mind and financial stability for you and your family in an uncertain economy.